When sleeping when to take into account the payment of salaries. How to keep track of wages on the simplified tax system? personal income tax from employees' income

What expenses reduce the simplified tax system "income minus expenses" in 2019? What is the new list of expenses with a breakdown? Details and a handy table are in this material.

The principle of "income minus expenses"

IP organizations that apply the “simplified system” (STS) in 2019 and pay a single tax on the difference between income and expenses have the right to reduce the tax base by the amount of expenses incurred by them (clause 2 of Article 346.18 of the Tax Code of the Russian Federation).

Having chosen the object of taxation “income reduced by the amount of expenses”, the payer of the simplified tax system in 2019 must keep records of income received and expenses incurred in the income and expenses ledger. And on the basis of this book to determine the total amount of tax payable.

What "falls" into income

As part of the income of the "simplified" one must take into account the income from sales and non-operating income (Article 346.15 of the Tax Code of the Russian Federation). At the same time, income under the simplified tax system is recognized on a "cash" basis. That is, the date of receipt of income is the day of receipt Money, obtaining other property or repaying debts in other ways (clause 1 of article 346.17 of the Tax Code of the Russian Federation).

What is included in the costs

The list of expenses that can be taken into account on simplified taxation is given in article 346.16 of the Tax Code of the Russian Federation and is closed. This means that not all costs can be taken into account, but only reasonable and documented costs listed in the specified list. This list includes, among others:

- expenses for the acquisition (construction, manufacture), as well as completion (additional equipment, reconstruction, modernization and technical re-equipment) of fixed assets;

- purchase costs or independent creation intangible assets;

- material expenses, including expenses for the purchase of raw materials and materials;

- labor costs;

- the value of purchased goods purchased for resale;

- amounts input VAT paid to suppliers;

- other taxes, fees and insurance premiums paid in accordance with the law. The exception is the single tax, as well as VAT allocated in invoices and paid to the budget in accordance with paragraph 5 of Article 173 of the Tax Code of the Russian Federation. These taxes cannot be included in expenses (subclause 22, clause 1, article 346.16 of the Tax Code of the Russian Federation).

- expenses for maintenance of CCP and removal of municipal solid waste;

- expenses for compulsory insurance employees, property and liability, etc.

Breakdown of expenses: table

Some novice accountants are surprised: “How can one understand exactly from Article 346.16 of the Tax Code of the Russian Federation whether it is possible to reduce the simplified tax system for a particular expense or not?” Yes, indeed, some of the costs described in this article raise questions. What, for example, relates to labor costs? Or what kind of costs in 2019 should be attributed to the removal of solid waste? As a rule, the Ministry of Finance or the Federal Tax Service comes to the rescue on such issues and gives their explanations. Based on the Tax Code of the Russian Federation and official clarifications, we have prepared a breakdown of expenses that in 2019 can be attributed to expenses under the simplified tax system with the object of taxation "income minus expenses". Here is a table with expenses, which are expenses that are not directly named in article 346.16, but which can be taken into account in expenses:

| Breakdown of expenses for the simplified tax system 2019 | |

|---|---|

| Expenses | How are they accounted for as expenses? |

| Fixed assets and intangible assets | |

| Interest expenses for the provided installment plan for the payment of fixed assets | Accepted as part of the expenses for the acquisition of fixed assets in the manner prescribed by paragraph 3 of Article 346.16 of the Tax Code of the Russian Federation (letter of the Ministry of Finance of Russia dated July 2, 2010 No. 03-11-11 / 182) |

| Expenses for the repurchase of a leased fixed asset | Included in expenses for the acquisition of fixed assets (subject to the transfer of ownership of the object and after its full payment) (letter of the Ministry of Finance of Russia dated January 20, 2011 No. 03-11-11 / 10) |

| Material costs | |

| The cost of forest plantations acquired under the entrepreneurial activity | It is taken into account as part of material expenses (subclause 5, clause 1, article 346.16 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated October 24, 2008 No. 03-11-05 / 255) |

| Expenses for payment of services of forestry enterprises for the allocation and registration of cutting areas | Taken into account as part of material expenses (subclause 5, clause 1, article 346.16 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated October 24, 2008 No. 03-11-05 / 255) |

| Expenses for breaking and cutting glass (in the absence of perpetrators) | They are taken into account within the norms of natural loss (subclause 5, clause 1, article 346.16, clause 2, clause 7, article 254 of the Tax Code of the Russian Federation). When writing off, you can be guided by the Norms approved by the USSR Ministry of Industry and Construction Materials dated October 21, 1982 (letter of the Ministry of Finance of Russia dated January 17, 2011 No. 03-11-11 / 06) |

| Freelance programmer fees | Taken into account if it can be justified that the services of a programmer are of a production nature (subclause 5, clause 1, article 346.16, clause 6, clause 1, article 254 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated November 3, 2009 No. 03-11-06 /2/235) |

| Costs for cleaning services | Taken into account if it can be justified that cleaning services are of an industrial nature (subclause 5, clause 1, article 346.16, clause 6, clause 1, article 254 of the Tax Code of the Russian Federation, letters of the Ministry of Finance of Russia dated April 13, 2011 No. 03-11 -06/2/53, dated November 3, 2009 No. 03-11-06/2/235) |

| Publisher's Printing and Distribution Costs periodicals(including when returning unsold printed materials from the distribution network) | Accounted for as expenses for payment for services of an industrial nature (subclause 5, clause 1, article 346.16, subclause 6, clause 1, article 254 of the Tax Code of the Russian Federation, letter of the Federal Tax Service of Russia for Moscow dated September 14, 2010 No. 16-15 / 105637 ) |

| Costs of recruitment agencies for payment of services for the placement of information about vacancies in the media | They are taken into account if the organization justifies that the services for posting information about vacancies are of an industrial nature (subclause 5, clause 1, article 346.16, clause 6, clause 1, article 254 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated August 16, 2012 No. 03 -11-06/2/111) |

| Expenses of the lessor for the maintenance of the building transferred for temporary use | They are taken into account as part of material costs as the cost of acquiring works and services of an industrial nature, performed on their own or by third parties. At the same time, under the terms of the contract, such costs should be borne by the lessor (subclause 5, clause 1, article 346.16, clause 6, clause 1, article 254 of the Tax Code of the Russian Federation, letters of the Ministry of Finance of Russia dated June 10, 2015 No. 03-11-09 /33555, dated July 1, 2013 No. 03-11-06/2/24988) |

| Equipment check costs | They are taken into account as part of material expenses (subclause 5, clause 1, article 346.16 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated January 31, 2014 No. 03-11-06/2/3799) |

| Print production costs | Accounted for as part of material costs as the cost of acquiring work and services of an industrial nature, performed on their own or by third parties (Subclause 5, Clause 1, Article 346.16, Subclause 6, Clause 1, Article 254 of the Tax Code of the Russian Federation) |

| Expenses for repair of ventilation and air conditioning systems in rented premises | They are taken into account as part of material expenses as the costs of acquiring work and services of an industrial nature, performed on their own or by third parties (subclause 5, clause 1, article 346.16, subclause 6, clause 1, article 254 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated February 15 2016 No. 03-11-06/2/8092) |

| taxes | |

| Taxes, fees, insurance premiums paid by the company itself | Reduce the tax base on the date of transfer of funds to the budget. The expenses include the amounts actually paid (Subclause 22, Clause 1, Article 346.16, Subclause 3, Clause 2, Article 346.17 of the Tax Code of the Russian Federation) |

| Taxes, fees, insurance premiums paid for the organization by third parties | Reduce the tax base on the date of repayment of the debt to the person who paid the tax (fee, insurance premium) for the organization. The expenses include only the amounts actually paid (subclause 22, clause 1, article 346.16, clause 3, clause 2, article 346.17 of the Tax Code of the Russian Federation) |

| VAT paid to the budget by a tax agent: - when purchasing goods from a foreign organization that is not tax registered in Russia - in the event of the return of these goods; - when transferring an advance payment on account of the forthcoming deliveries of goods (performance of work, provision of services) under an agreement with a foreign organization that is not tax registered in Russia - in case of termination of the agreement and return of the advance payment | Chapter 26.2 of the Tax Code of the Russian Federation does not directly provide for such types of expenses. However, subparagraph 22 of paragraph 1 of Article 346.16 of the Tax Code of the Russian Federation establishes that the expenses include the amounts of taxes paid in accordance with the legislation on taxes and fees (except for the single tax when simplified). The duties of a tax agent of an organization applying simplified taxation are performed in accordance with paragraph 5 of Article 346.11 of the Tax Code of the Russian Federation. The right to recognize these expenses when calculating a single tax is provided for in paragraph 7 of Article 170 of the Tax Code of the Russian Federation |

| Personal income tax deducted from employees' salaries | It is taken into account as part of labor costs as the tax is transferred to the budget (subclause 1, clause 2, article 346.17 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated June 25, 2009 No. 03-11-09 / 225). For more information on this, see How to reflect income and expenses in the book of accounting for income and expenses when simplified |

| Personal income tax withheld from the amount of interest paid to the lender - an individual | It is taken into account as part of the interest paid for the funds provided, in the manner prescribed by Article 269 of the Tax Code of the Russian Federation (subclause 9, clause 1, clause 2, Article 346.16 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated February 13, 2009 No. 03-11 -06/2/27). The interest paid is included in expenses on the basis of subparagraph 9 of paragraph 1 of Article 346.16 of the Tax Code of the Russian Federation, together with personal income tax, the amount of which the organization withholds and transfers to the budget |

| Taxes paid abroad under foreign tax laws | Chapter 26.2 of the Tax Code of the Russian Federation does not directly provide for such types of expenses. However, subparagraph 22 of paragraph 1 of Article 346.16 of the Tax Code of the Russian Federation establishes that the expenses include the amounts of taxes paid in accordance with the legislation on taxes and fees (except for the single tax when simplified). Tax disclaimer Russian Federation since 2013, it has been excluded from this norm (subparagraph “b”, paragraph 13, article 2 of the Law of June 25, 2012 No. 94-FZ) |

| Labor costs | |

| Prizes for professional excellence, high achievements in work and other similar indicators (in particular, bonuses paid in connection with the awarding of honorary professional badges, awarding honorary professional titles) | Taken into account as part of labor costs (Subclause 6, Clause 1, Clause 2, Article 346.16, Article 255 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated August 16, 2010 No. 03-11-06/2/127) |

| Supplement to sickness benefit up to actual average earnings | Supplements to hospital benefits up to actual average earnings can be included in labor costs if they are provided for by labor and (or) collective agreements (subparagraph 6, paragraph 1, paragraph 2, article 346.16, article 255 of the Tax Code of the Russian Federation, letter from the Ministry of Finance Russia dated December 23, 2009 No. 03-03-05/248). Despite the fact that the letter explains the procedure for accounting for such surcharges when calculating income tax, single tax payers can also be guided by these explanations when simplified (clause 2 of article 346.16, article 255 of the Tax Code of the Russian Federation) |

| Alimony withheld from an employee's income | They are taken into account as part of labor costs as alimony is transferred to recipients (subclause 1, clause 2, article 346.17 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated June 25, 2009 No. 03-11-09 / 225). Labor costs for simplification are taken into account in the manner prescribed by Article 255 of the Tax Code of the Russian Federation (Subparagraph 6, Clause 1 and Clause 2, Article 346.16 of the Tax Code of the Russian Federation). Under this item, the expenses reflect the entire accrued salary, which includes alimony to be withheld |

| Contributions for voluntary personal insurance of employees in case of death or injury to health | They are taken into account as part of labor costs in the manner prescribed for calculating income tax (subparagraph 6, paragraph 1, paragraph 2, article 346.16, article 255 of the Tax Code of the Russian Federation). That is, if the insurance contract: - concluded with an insurance company that has a valid license; The maximum amount of insurance premiums, which reduces the tax base, is 15,000 rubles. per employee per year. |

| other expenses | |

| Internet access costs | Taken into account as part of the costs of communication services (subclause 18, clause 1, article 346.16 of the Tax Code of the Russian Federation, letters of the Ministry of Finance of Russia dated October 9, 2007 No. 03-11-04 / 2/250, dated April 2, 2007 No. 03-11 -04/2/79, March 27, 2006 No. 03-11-04/2/70, December 28, 2005 No. 03-11-04/2/163, December 15, 2005 No. 03- 11-04/2/151) |

| Costs of commitents, principals, principals for the payment of intermediary fees | Actually paid (withheld by the intermediary from the funds due to the committent (principal, trustee)) remuneration is included in the expenses as of the date of approval of the intermediary's report (subclause 24 clause 1 article 346.16 of the Tax Code of the Russian Federation, letters of the Federal Tax Service of Russia for Moscow dated September 2, 2010 No. 20-14/2/092620, February 4, 2009 No. 20-14/009034) |

| The cost of purchasing accounting computer programs, electronic reference and legal (information) systems and databases, as well as the costs of their maintenance and updating | Taken into account on the basis of subparagraph 19 of paragraph 1 of article 346.16 of the Tax Code of the Russian Federation (letters of the Ministry of Finance of Russia dated January 19, 2016 No. 03-11-06 / 2/1520, dated March 21, 2013 No. 03-11-06 / 2/8830 Federal Tax Service of Russia dated October 14, 2011 No. ED-4-3 / 17020) |

| Expenses related to the repayment of loans (for example, the payment of interest) on the obligations of the affiliated organization (after reorganization in the form of affiliation) | Accounted for in accordance with subparagraph 9 of paragraph 1 of Article 346.16 of the Tax Code of the Russian Federation. The basis is Article 58 of the Civil Code of the Russian Federation, according to which, in the event of reorganization in the form of affiliation, all rights and obligations of the affiliated organization pass to the organization (letter of the Ministry of Finance of Russia dated June 7, 2010 No. 03-11-06 / 2/90) |

| Costs for paying for banking services using the "Client-Bank" system | |

| Expenses for paying the bank commission for performing the functions of a currency control agent | Taken into account on the basis of subparagraph 9 of paragraph 1 of article 346.16 of the Tax Code of the Russian Federation (letter of the Ministry of Finance of Russia dated April 21, 2014 No. 03-11-06 / 2 / 18229) |

| Expenses for paying a commission to a credit institution for issuing certificates as part of a banking operation | Taken into account on the basis of subparagraph 9 of paragraph 1 of Article 346.16 of the Tax Code of the Russian Federation |

| Expenses for insurance of civil liability of owners of hazardous facilities listed in Article 5 of the Law of July 27, 2010 No. 225-FZ | Taken into account in accordance with subparagraph 7 of paragraph 1 of article 346.16 of the Tax Code of the Russian Federation (letter of the Ministry of Finance of Russia dated March 12, 2012 No. 03-11-06 / 2/41) |

| The cost of paying for the mandatory inspection control over the organization's quality management certification system | Taken into account on the basis of subparagraph 26 of paragraph 1 of article 346.16 of the Tax Code of the Russian Federation (letter of the Ministry of Finance of Russia dated January 31, 2014 No. 03-11-06/2/3799) |

| Expenses for accounting, auditing and legal services (including legal services related to obtaining a license) | Taken into account on the basis of subparagraph 15 of paragraph 1 of Article 346.16 of the Tax Code of the Russian Federation (letters of the Ministry of Finance of Russia dated July 16, 2010 No. 03-11-06 / 2/112, Federal Tax Service of Russia for Moscow dated January 22, 2010 No. 16-15 / 005297) |

| Expenses for paying for the services of specialized organizations for conducting examinations, surveys, issuing opinions and submitting other documents, the presence of which is mandatory for obtaining a license | Taken into account on the basis of subparagraph 30 of paragraph 1 of Article 346.16 of the Tax Code of the Russian Federation |

| Attorney fees. For example, if a lawyer is involved to represent the interests of the organization in a litigation with the tax office | Taken into account on the basis of subparagraph 15 or subparagraph 31 of paragraph 1 of Article 346.16 of the Tax Code of the Russian Federation |

| Expenses for the removal of municipal solid waste | Taken into account on the basis of subparagraph 36 of paragraph 1 of Article 346.16 of the Tax Code of the Russian Federation |

| Payments under license agreements for the granted right to public display (demonstration) of films (“rental fee”) | Taken into account on the basis of subparagraph 32 of paragraph 1 of article 346.16 of the Tax Code of the Russian Federation (letter of the Ministry of Finance of Russia dated March 11, 2013 No. 03-11-06 / 2/7122) |

| Expenses for the purchase of cash registers (including online cash registers), as well as expenses for paying for the services of an operator for processing fiscal data | Taken into account on the basis of subparagraphs 18 and 35 of paragraph 1 of article 346.16 of the Tax Code of the Russian Federation (letter of the Ministry of Finance of Russia dated December 9, 2016 No. 03-11-06/2/73772) |

How to keep records wages on USN?

Labor costs for the general and simplified systems by type of payment are the same. But the procedure for their recognition in comparison with the accrual method is completely different, since the “simplified” system is based on the cash method of accounting. This causes difficulties for accountants of construction companies. Let's talk about the most common

Basic norms

Based on the provisions of paragraph 2 of Article 346.16 of the Tax Code of the Russian Federation, only those payments that are named in Article 255 of the Tax Code of the Russian Federation are recognized as labor costs for the purposes of simplified tax.

Recall that with the "simplification" there are two objects of taxation: "income" and "income reduced by the amount of expenses." And only on the simplified tax system, which have chosen the object “income minus expenses”, they have the right to reduce the tax base by the amount of wages on the basis of subparagraph 6 of paragraph 1 of Article 346.16 of the Tax Code of the Russian Federation.

Labor costs are taken into account as expenses at the time of their actual payment, and in case of another method of debt repayment - at the time of such repayment (subclause 1, clause 2, article 346.17 of the Tax Code of the Russian Federation). They are reflected in the book of income and expenses ... (approved by order of October 22, 2012 No. 135n) on one of the following dates:

- on the date of payment from the cash desk;

- on the date of debiting from the current account, if the salary is transferred to the personal accounts of employees in

- as of the date of transfer of goods, works, services, if the salary is paid in non-monetary form (we will not consider other ways of paying off obligations in this article).

Please note that a direct connection with Article 255 of the Tax Code of the Russian Federation introduces, for "simplification", the same restrictions on the recognition of a number of payments to employees in tax expenses, as in the general system. For example, payments to employees during study holidays can only be taken into account in the amount of average earnings. And payments to employees for reimbursement of their expenses for paying interest on loans (credits) for the purchase or construction of housing are taken into account in an amount not exceeding 3 percent of the total amount of labor costs. Such provisions are contained in paragraphs 13, 24.1 of Article 255 of the Tax Code of the Russian Federation.

It should also be noted that Article 131 of the Labor Code of the Russian Federation prohibits the payment of wages in kind if its share exceeds 20 percent of the accrued monthly amount of earnings.

It follows from the foregoing that the construction company transfers personal income tax from wages (including for the first half of the month) to the budget once a month at the end of each month.

Change of object of taxation

Let's pay attention to one more possible problem. Financiers do not allow to take into account in expenses the salary accrued when using the "simplification" with the "income" object, which was paid later - already when using the "income minus expenses" object. That is, if, say, a construction company has changed the object of taxation since 2014, it will not be able to take into account the salary for December 2013, paid in January 2014, in expenses. If we take the letters of the Ministry of Finance of Russia dated September 7, 2010 No. 03-11-06 / 2/142, dated July 8, 2009 No. 03-11-06 / 2/121, dated April 22, 2008 No. 03-11- 04/2/75, where such a situation was considered, we will see that the financiers are categorically against accounting for such costs in January next year, referring to paragraph 4 of Article 346.17 of the Tax Code of the Russian Federation.

The fact is that there is a contradiction in the norms of the legislation. According to paragraph 4 of Article 346.17 of the Tax Code of the Russian Federation, expenses relating to tax periods in which the object of taxation in the form of income was applied cannot be taken into account as expenses of the tax period with the new object “income reduced by the amount of expenses”. At the same time, in accordance with paragraph 2 of the same article, the expenses of the taxpayer are recognized as expenses after their actual payment.

It is obvious that the financiers here interpret the phrase “related expenses” based on the accrual method: if the salary is accrued in December, then it refers to December. But under the simplified regime, the cash basis is used, in which the expenses are related to the payment period.

A. Anischenko,

LLC “Auditing firm “Atoll-AF””

Wage in 2014 under the simplified tax system is a topic that is covered in our article. In the article we will tell you what forms of remuneration exist, how to pay salaries, what are the requirements for paying salaries (twice a month), how to tax personal income tax and contributions, etc.

Settlements with employees are perhaps one of the most difficult areas of accounting work. Payments to personnel attract the attention of the labor inspectorate, inspectors from non-budgetary funds, and tax authorities.

Questions and answers on wages under the simplified tax system in 2014

To help simplified people in matters of payroll, the Simplified magazine has released a unique application. This is a guide compiled in the form of answers to the most frequently asked questions about salaries. The guide is posted. To read, get free access for three days.

Here are the answers to the questions in the guide:

Payroll

Payment of wages

Reflection of wages in accounting

Vacation

Social benefits

Forms of remuneration

Article 131 of the Labor Code of the Russian Federation establishes that wages are paid in rubles. According to part 2 of article 131 of the Labor Code of the Russian Federation, wages can also be paid in non-monetary form.

The natural (non-monetary) share of wages, including VAT, can never be more than 20% of the salary accrued to the employee for the month, including personal income tax (Article 131 of the Labor Code of the Russian Federation). The calculation does not take into account the amounts of sick leave, travel and other payments that are not wages (Article 129 of the Labor Code of the Russian Federation).

In addition, for the payment of wages in kind, all of the following conditions must be met (clause 54 of the Decree of the Plenum of the Supreme Court of the Russian Federation dated March 17, 2004 No. 2):

- the possibility of such payment should be provided for by a collective or labor contract or an additional agreement to the labor contract;

- the employee wrote a statement asking him to give him part of the salary in kind. Such a statement can be written for the payment of wages both for a specific month and for a specific period (for example, a quarter);

- Goods given out on account of wages must be suitable for personal consumption by the employee or members of his family (food, clothing, household items). It is impossible to issue salaries in bonds, coupons, in the form of promissory notes, as well as in the form of alcoholic beverages, narcotic, poisonous, harmful and other toxic substances and other goods prohibited or restricted in free circulation;

- the value at which the goods are transferred to payroll (including VAT) does not exceed their market value.

In practice, the question sometimes arises: is it possible to set wages in conventional units or foreign currency? Formally, the Labor Code of the Russian Federation does not prohibit this, provided that it will be paid in rubles and its size will be the same for equal work (Article 22 of the Labor Code of the Russian Federation).

At the same time, the establishment of wages in any other units, except for rubles, with conversion into rubles on the last date of the month, implies a change in the amount of wages in rubles, depending on the exchange rate, while the provisions of Art. 132 of the Labor Code of the Russian Federation of criteria determining the amount of remuneration (qualifications, complexity of the work performed, quantity and quality of labor expended).

Such a change in wages in different periods for the same work, on formal grounds, is a change in the mandatory terms of the employment contract and must be made by virtue of Article 72 of the Labor Code of the Russian Federation by agreement of the parties in writing.

In addition, it must be borne in mind that when filling out standard forms of primary documents for accounting for labor and wages, only rubles are indicated as units of measurement. The Ministry of Finance, in a letter dated 12.01.2007 No. 03-03-04 / 1/866, notes that for tax purposes it is illegal to draw up primary documents in conventional units (foreign currency). Therefore, the amounts expressed in foreign currency, for formal reasons, may be excluded by the regulatory authorities from the costs accounted for for tax purposes.

Payroll Requirements

The salary of employees must be paid at least every half a month on the days and in the manner established by the labor or collective agreement or in the internal labor regulations (Article 131, Parts 3, 4, 6 of Article 136 of the Labor Code of the Russian Federation):

- or cash;

- or transfer to employee cards.

If the salary payment day falls on a weekend or holiday, then the salary must be paid no later than the last working day before this weekend or holiday (part 8 of article 136 of the Labor Code of the Russian Federation).

For late payment of wages, the employer must pay compensation to the employee (Article 236 of the Labor Code of the Russian Federation).

When paying wages for the second part of the month, the employee must be given a payslip in the form approved by the order of the head of the organization (part 2 of article 136 of the Labor Code of the Russian Federation, clause 3 of the Letter of Rostrud dated December 24, 2007 No. 5277-6-1). The pay slip must indicate (part 1 of article 136 of the Labor Code of the Russian Federation):

1) all amounts accrued to the employee for this month by components (salary, bonus, allowances, etc.);

2) all amounts withheld from the employee's income for this month (personal income tax, deductions by order of the employer, according to executive documents, etc.);

3) the amount to be received on hand.

Taxation

All salary accrued to the employee:

- subject to insurance premiums (part 1, article 7 of Law No. 212-FZ);

- subject to income tax. The tax must be withheld from the monetary part of the salary when it is paid;

- is taken into account in labor costs under the simplified tax system (Article 255, subclause 6, clause 1, article 346.16 of the Tax Code of the Russian Federation). If the conditions for paying wages in kind are violated, the IFTS may exclude the “in kind” part of the salary from expenses (clause 1 of the Letter of the Ministry of Finance dated November 12, 2009 No. 03-03-06 / 2/223).

Simplifiers recognize costs after they are actually paid. Therefore, labor costs should be taken into account at the time of debt repayment by debiting funds from the taxpayer's current account, payment from the cash desk, and in case of another method of debt repayment - at the time of such repayment (clause 1, clause 2, article 346.17 of the Tax Code of the Russian Federation).

For information on how you can compare taxation systems in order to legally reduce payments to the budget when doing business, read the article ". And for those who still have questions or who want to get advice from a professional, we can offer free consultation on taxation from 1C specialists:

Benefits of using the USN 2019

Simplified tax system, USN, simplified - these are all the names of the most popular taxation system among small and medium-sized businesses. The attractiveness of the simplified tax system is due to both a small tax burden and the relative ease of accounting and reporting, especially for individual entrepreneurs.

In our service, you can prepare a notification about the transition to the simplified tax system for free (relevant for 2019)

The simplified system combines two different options taxation, differing in the tax base, tax rate and tax calculation procedure:

- USN Income,

Is it always possible to say that the simplified tax system is the most profitable and easiest taxation system to account for? It is impossible to answer this question unambiguously, since it is possible that in your particular case the simplification will be neither very profitable nor very simple. But we must admit that the simplified tax system is flexible and handy tool, which allows you to regulate the tax burden of the business.

It is necessary to compare tax systems according to several criteria, we suggest briefly going through them, noting the features of a simplified tax system.

1. Amounts of payments to the state when conducting activities on the simplified tax system

We are talking here not only about payments to the budget in the form of taxes, but also about payments for pension, medical and social insurance workers. Such transfers are called insurance premiums, and sometimes payroll taxes (which is incorrect from an accounting point of view, but understandable for those who pay these premiums). account for an average of 30% of the amounts paid to employees, and individual entrepreneurs are required to transfer these contributions also for themselves personally.

Simplified tax rates are significantly lower than the tax rates of the general taxation system. For the simplified tax system with the “Income” object, the tax rate is only 6%, and since 2016, the regions have received the right to reduce the tax rate on the simplified tax system “Income” to 1%. For the simplified tax system with the "Income minus expenses" object, the tax rate is 15%, but it can also be reduced by regional laws up to 5%.

In addition to the reduced tax rate, the STS Income has another advantage - the possibility of a single tax due to insurance premiums listed in the same quarter. Working in this mode legal entities and individual entrepreneurs-employers can reduce the single tax to 50%. Individual entrepreneurs without employees on the simplified tax system can take into account the entire amount of contributions, as a result of which, with small incomes, there may not be a single tax payable at all.

On the STS Income minus expenses, the listed insurance premiums can be taken into account in expenses when calculating the tax base, but this calculation procedure also applies to other tax systems, so it cannot be considered a specific advantage of the simplified system.

Thus, the simplified tax system is, of course, the most beneficial tax system for a businessman, if taxes are calculated based on income received. Less profitable, but only in some cases, the simplified system can be compared with the UTII system for legal entities and individual entrepreneurs and regarding the cost of a patent for individual entrepreneurs.

We draw the attention of all LLCs to the simplified tax system - organizations can pay taxes only by bank transfer. This is a requirement of Art. 45 of the Tax Code of the Russian Federation, according to which the obligation of the organization to pay tax is considered fulfilled only after the presentation of a payment order to the bank. The Ministry of Finance prohibits the payment of taxes by LLC in cash. We recommend that you open a current account on favorable terms.

2. The complexity of accounting and reporting on the simplified tax system

According to this criterion, the USN also looks attractive. Tax accounting on a simplified system is maintained in a special Book of Income and Expenses (KUDiR) for the USN (form,). Since 2013, legal entities have also been keeping accounting on a simplified basis; individual entrepreneurs do not have such an obligation.

So that you can try the accounting outsourcing option without any material risks and decide whether it suits you, we, together with 1C, are ready to provide our users with a month of free accounting services:

Reporting on the simplified tax system is represented by only one declaration, which must be submitted at the end of the year by March 31 for organizations and by April 30 for individual entrepreneurs.

For comparison, VAT payers, enterprises on the general tax system and UTII, as well as individual entrepreneurs on UTII submit declarations quarterly.

We must not forget that on the simplified tax system, except for the tax period, i.e. calendar year, there are also reporting periods - the first quarter, six months, nine months. Although the period is called the reporting period, according to its results, it is not necessary to submit a declaration on the simplified tax system, but it is necessary to calculate and pay advance payments according to KUDiR, which will then be taken into account when calculating the single tax at the end of the year (examples with calculations of advance payments are given at the end of the article).

| More: |

3. Disputes between USN payers and tax and judicial authorities

An infrequently taken into account, but a significant plus of the simplified income tax regime is also that the taxpayer in this case does not need to prove the validity and correct documentation of expenses. It is enough to record the income received in KUDiR and, at the end of the year, submit a declaration on the simplified tax system, without worrying that, based on the results of a desk audit, arrears, penalties and fines may be accrued due to the non-recognition of some expenses. When calculating the tax base in this mode, expenses are not taken into account at all.

For example, disputes with tax authorities on the recognition of expenses when calculating income tax and the justification of losses bring businessmen even to the Supreme Arbitration Court (what are the cases of tax authorities not recognizing expenses for drinking water and toiletries in offices). Of course, taxpayers on the simplified tax system Income minus expenses must also confirm their expenses with correctly executed documents, but there are noticeably fewer disputes about their validity. Closed, i.e. a strictly defined list of expenses that can be taken into account when calculating the tax base is given in Article 346.16 of the Tax Code of the Russian Federation.

The Simplifiers are also lucky in that they are not (except for VAT when importing goods into the Russian Federation) a tax, which also provokes a lot of disputes and is difficult to administer, i.е. accrual, payment and return from the budget.

USN is much less likely to lead to. On this system, there are no such audit risk criteria as reporting losses when calculating income tax, a high percentage of expenses in the income of an entrepreneur when calculating personal income tax, and a significant share of VAT recoverable from the budget. The consequences of an on-site tax audit for business are not related to the topic of this article, we only note that for enterprises the average amount of additional charges based on its results is more than one million rubles.

It turns out that a simplified system, especially the version of the simplified tax system Income, reduces the risks of tax disputes and field audits, and this must be recognized as an additional advantage.

4. The possibility of work of taxpayers of the simplified tax system with taxpayers in other modes

Perhaps the only significant disadvantage of the simplified tax system is the limitation of the circle of partners and buyers to those who do not need to take into account the input VAT. A counterparty working with VAT is likely to refuse to work with a simplifier, unless their VAT costs are offset by a lower price for your goods or services.

General information about the USN 2019

If you consider the simplified system beneficial and convenient for yourself, we suggest that you familiarize yourself with it in more detail, for which we turn to the original source, i.e. Chapter 26.2 of the Tax Code of the Russian Federation. We will begin our acquaintance with the simplified tax system with the one who can still apply this taxation system.

Can apply simplified tax system in 2019

Taxpayers on the simplified tax system can be organizations (legal entities) and individual entrepreneurs ( individuals), unless they are subject to a number of restrictions as listed below.

An additional restriction applies to an already operating organization that can switch to a simplified regime if, following the results of 9 months of the year in which it submits a notification of the transition to the simplified tax system, its sales and non-operating income did not exceed 112.5 million rubles. These restrictions do not apply to individual entrepreneurs.

- banks, pawnshops, investment funds, insurers, private pension funds, professional participants in the securities market, microfinance organizations;

- organizations with branches;

- state and budgetary institutions;

- organizations conducting and organizing gambling;

- foreign organizations;

- organizations that are parties to production sharing agreements;

- organizations in which the share of participation of other organizations is more than 25% (with the exception of non-profit organizations, budgetary scientific and educational institutions and those in which the authorized capital consists entirely of contributions from public organizations of the disabled);

- organizations, the residual value of fixed assets in which is more than 150 million rubles.

Cannot apply simplified tax system in 2019

Organizations and individual entrepreneurs cannot apply the simplified tax system:

- producing excisable goods (alcohol and tobacco products, cars, gasoline, diesel fuel, etc.);

- extracting and selling minerals, except for common ones, such as sand, clay, peat, crushed stone, building stone;

- switched to a single agricultural tax;

- having more than 100 employees;

- who did not report the transition to the simplified tax system within the time and in the manner prescribed by law.

The USN also does not apply to the activities of private notaries, lawyers who have established law offices, and other forms of lawyer formations.

To avoid a situation in which you will not be able to apply the simplified tax system, we recommend that you carefully consider the choice of OKVED codes for individual entrepreneurs or LLCs. If any of the selected codes corresponds to the activity above, then the tax will not allow reporting on it to the simplified tax system. For those who doubt their choice, we can offer a free selection of OKVED codes.

Object of taxation on the simplified tax system

A distinctive feature of the simplified tax system is the possibility for the taxpayer to voluntarily choose the object of taxation between “Income” and “Income reduced by the amount of expenses” (which is often called “Income minus expenses”).

The taxpayer can make his choice between the objects of taxation "Income" or "Income minus expenses" annually, having previously notified the tax office before December 31 of his intention to change the object from the new year.

Note: The only restriction on the possibility of such a choice applies to taxpayers - participants in a simple partnership agreement (or on joint activity), as well as an agreement on trust management of property. The object of taxation on the simplified tax system for them can only be “Income minus expenses”.

Tax base on the simplified tax system

For the object of taxation "Income", the tax base is the monetary value of income, and for the object "Income minus expenses", the tax base is the monetary value of income reduced by the amount of expenses.

Articles 346.15 to 346.17 of the Tax Code of the Russian Federation indicate the procedure for determining and recognizing income and expenses under this regime. The following are recognized as income on the simplified tax system:

- sales revenue, i.e. proceeds from the sale of goods, works and services of own production and previously acquired, and proceeds from the sale of property rights;

- non-operating income specified in Art. 250 of the Tax Code of the Russian Federation, such as property received free of charge, income in the form of interest under loan agreements, credit, bank account, securities, positive exchange rate and sum difference, etc.

Expenses recognized on the simplified system are given in Art. 346.16 of the Tax Code of the Russian Federation.

Tax rates for the simplified tax system

The tax rate for the STS Income variant is generally 6%. For example, if you received income in the amount of 100 thousand rubles, then the amount of tax will be only 6 thousand rubles. In 2016, the regions received the right to reduce the tax rate on the STS Income to 1%, but not all of them use this right.

The usual rate for the STS option "Income minus expenses" is 15%, but the regional laws of the subjects of the Russian Federation may reduce the tax rate to 5% to attract investment or develop certain types of activities. You can find out what rate is valid in your region at the tax office at the place of registration.

For the first time registered IP on the simplified tax system can receive, i.e. the right to work at a zero tax rate if a corresponding law is passed in their region.

Which object to choose: STS Income or STS Income minus expenses?

There is a fairly conditional formula that allows you to show at what level of expenses the amount of tax on the simplified tax system Income will be equal to the amount of tax on the simplified tax system Income minus expenses:

Income*6% = (Income - Expenses)*15%

In accordance with this formula, the STS tax amounts will be equal when expenses amount to 60% of income. Further, the greater the costs, the less the tax payable, i.e. with equal incomes, the STS option Income minus expenses will be more profitable. However, this formula does not take into account three important criteria that can significantly change the calculated tax amount.

1. Recognition and accounting of expenses for calculating the tax base for the simplified tax system Income minus expenses:

USN Expenses Income minus expenses must be properly documented. Unacknowledged expenses will not be taken into account when calculating the tax base. To confirm each expense, you must have a document confirming its payment (such as a receipt, account statement, payment order, cash receipt) and a document confirming the transfer of goods or the provision of services and the performance of work, i.e. waybill for the transfer of goods or an act for services and works;

Closed list of expenses. Not all expenses, even properly executed and economically justified, can be taken into account. A strictly limited list of expenses recognized for the simplified tax system Income minus expenses is given in Art. 346.16 of the Tax Code of the Russian Federation.

Special procedure for recognition of certain types of expenses. So, in order to take into account the costs of purchasing goods intended for further sale on the USN Income minus expenses, it is necessary not only to document the payment for these goods to the supplier, but also to sell them to your buyer (Article 346.17 of the Tax Code of the Russian Federation).

Important point- under the implementation is understood not the actual payment for the goods by your buyer, but only the transfer of the goods to his property. This issue was considered in the Resolution of the Supreme Arbitration Court of the Russian Federation No. 808/10 dated 29.06. 2010, according to which "... it does not follow from the tax legislation that the condition for including the cost of purchased and sold goods in expenses is their payment by the buyer." Thus, in order to offset the expenses for the purchase of goods intended for further sale, the simplifier must pay for these goods, credit them and sell them, i.e. hand over to the buyer. The fact that the buyer paid for this product when calculating the tax base for the simplified tax system Income minus expenses will not matter.

Another difficult situation is possible if you received an advance payment from your buyer at the end of the quarter, but did not have time to transfer the money to the supplier. Suppose a trading and intermediary firm on the simplified tax system received an advance payment in the amount of 10 million rubles, of which 9 million rubles. must be paid to the supplier. If for some reason they did not manage to pay the supplier in the reporting quarter, then according to its results, an advance payment must be made, based on the income received in 10 million rubles, i.e. 1.5 million rubles (at the usual rate of 15%). Such an amount can be significant for the STS payer, who works with the buyer's money. In the future, after proper registration, these costs will be taken into account when calculating the single tax for the year, but the need to pay such amounts immediately can be an unpleasant surprise.

2. Opportunity to reduce the single tax on the simplified tax system Income from paid insurance premiums. It has already been said above that in this regime it is possible to reduce the single tax itself, and in the simplified tax regime, income minus expenses, insurance premiums can be taken into account when calculating the tax base.

✐Example ▼

3. Reduction of the regional tax rate for the STS Income minus expenses from 15% to 5%.

If your region adopted a law establishing a differentiated tax rate for taxpayers applying the STS in 2019, then this will be a plus in favor of the STS Income minus expenses option, and then the level of expenses can be even less than 60%.

✐Example ▼

The procedure for the transition to the simplified tax system

Newly registered business entities (IE, LLC) can switch to the simplified tax system by submitting no later than 30 days from the date of state registration. Such a notification can also be submitted to the tax office immediately along with documents for registering an LLC or registering an individual entrepreneur. Most inspections request two copies of the notice, but some IFTS require three. One copy will be returned to you with a stamp from the tax office.

If, according to the results of the reporting (tax) period in 2019, the taxpayer's income on the simplified tax system exceeded 150 million rubles, then he loses the right to use the simplified system from the beginning of the quarter in which the excess was allowed.

In our service, you can prepare a notification about the transition to the simplified tax system for free (relevant for 2019):

Already operating legal entities and individual entrepreneurs can switch to the simplified tax system only from the beginning of the new calendar year, for which a notification must be submitted no later than December 31 of the current year (the notification forms are similar to those indicated above). As for UTII payers who have stopped conducting a certain type of activity on the imputation, they can apply for the simplified tax system and within a year. The right to such a transition is given by paragraph 2 of clause 2 of Article 346.13 of the Tax Code of the Russian Federation.

Single tax for the simplified tax system 2019

Let's figure out how taxpayers should calculate and pay tax on the simplified tax system in 2019. The tax paid by the simplistic people is called the single tax. The single tax replaces for enterprises the payment of income tax, property tax, etc. Of course, this rule is not without exceptions:

- VAT must be paid to simplistic people when importing goods into the Russian Federation;

- Enterprises on the simplified tax system must also pay property tax, if this property, according to the law, will be assessed at the cadastral value. In particular, starting from 2014, such a tax must be paid by enterprises that own retail and office space, but so far only in those regions where relevant laws have been adopted.

For individual entrepreneurs, a single tax replaces personal income tax from business activities, VAT (except for VAT when imported into the territory of the Russian Federation) and property tax. Individual entrepreneurs can receive exemption from paying tax on property used in entrepreneurial activities if they apply with a corresponding application to their tax office.

Tax and reporting periods on the simplified tax system

As we have already figured out above, the calculation of the single tax differs for the STS Income and STS Income minus expenses with its rate and tax base, but they are the same for them.

The tax period for calculating the tax on the simplified tax system is a calendar year, although this can only be said conditionally. The obligation to pay tax in installments or advance payments arises at the end of each reporting period, which is a quarter, six months and nine months of a calendar year.

The deadlines for the payment of advance payments for a single tax are as follows:

- according to the results of the first quarter - April 25;

- at the end of the half year - July 25;

- following the results of nine months - October 25.

The single tax itself is calculated at the end of the year, taking into account all advance payments already made quarterly. Deadline for tax payment on the simplified tax system at the end of 2019:

- until March 31, 2020 for organizations;

- until April 30, 2020 for individual entrepreneurs.

For violation of the terms of payment of advance payments for each day of delay, a fine is charged in the amount of 1/300 of the refinancing rate of the Central Bank of the Russian Federation. If the single tax itself is not transferred at the end of the year, then in addition to the penalty fee, a fine of 20% of the unpaid tax amount will be imposed.

Calculation of advance payments and single tax on the simplified tax system

The single tax is calculated on an accrual basis, i.e. cumulative total since the beginning of the year. When calculating the advance payment based on the results of the first quarter, it is necessary to multiply the calculated tax base by the tax rate, and pay this amount before April 25.

Considering the advance payment based on the results of the six months, it is necessary to multiply the tax base received based on the results of 6 months (January-June) by the tax rate, and subtract the already paid advance payment for the first quarter from this amount. The rest must be transferred to the budget by July 25.

Calculation of the advance for nine months is similar: the tax base calculated for 9 months from the beginning of the year (January-September) is multiplied by the tax rate and the amount received is reduced by advances already paid for the previous three and six months. The remaining amount must be paid by October 25th.

At the end of the year, we calculate a single tax - we multiply the tax base for the entire year by the tax rate, subtract all three advance payments from the resulting amount and pay the difference by March 31 (for organizations) or April 30 (for individual entrepreneurs).

Calculation of tax for the simplified tax system Income 6%

The peculiarity of the calculation of advance payments and the single tax on the simplified taxation system Income is the ability to reduce the calculated payments by the amount of insurance premiums transferred in the reporting quarter. Enterprises and individual entrepreneurs with employees can reduce tax payments up to 50%, but only within the limits of contributions. Individual entrepreneurs without employees can reduce the tax on the entire amount of contributions, without a limit of 50%.

✐Example ▼

IP Alexandrov on the simplified tax system Income, having no employees, received income in the 1st quarter of 150,000 rubles. and paid insurance premiums for himself in the amount of 9,000 rubles in March. Advance payment in 1 sq. will be equal to: (150,000 * 6%) = 9,000 rubles, but it can be reduced by the amount of contributions paid. That is, in this case, the advance payment is reduced to zero, so it is not necessary to pay it.

In the second quarter, an income of 220,000 rubles was received, total for the half year, i.e. from January to June, the total amount of income was 370,000 rubles. In the second quarter, the entrepreneur also paid insurance premiums in the amount of 9,000 rubles. When calculating the advance payment for half a year, it must be reduced by the contributions paid in the first and second quarters. Let's calculate the advance payment for the six months: (370,000 * 6%) - 9,000 - 9,000 = 4,200 rubles. The payment was made on time.

The entrepreneur's income for the third quarter amounted to 179,000 rubles, and he paid 10,000 rubles in insurance premiums in the third quarter. When calculating the advance payment for nine months, we first calculate all the income received since the beginning of the year: (150,000 + 220,000 + 179,000 = 549,000 rubles) and multiply it by 6%.

We will reduce the amount received, equal to 32,940 rubles, by all paid insurance premiums (9,000 + 9,000 + 10,000 = 28,000 rubles) and by the advance payments transferred following the results of the second quarters (4,200rubles). In total, the amount of the advance payment following the results of nine months will be: (32,940 - 28,000 - 4,200 = 740 rubles).

Until the end of the year, IE Alexandrov earned another 243,000 rubles, and his total annual income amounted to 792,000 rubles. In December, he paid the remaining amount of insurance premiums in the amount of 13,158 rubles*.

*Note: according to the rules for calculating insurance premiums in force in 2019, IP contributions for themselves amount to 36,238 rubles. plus 1% of income exceeding 300 thousand rubles. (792,000 - 300,000 = 492,000 * 1% = 4920 rubles). At the same time, 1% of income can be paid at the end of the year, until July 1, 2020. In our example, an individual entrepreneur paid the entire amount of contributions in the current year in order to be able to reduce the single tax at the end of 2019.

We calculate the annual single tax of the simplified tax system: 792,000 * 6% = 47,520 rubles, but during the year advance payments were made (4,200 + 740 = 4,940 rubles) and insurance premiums (9,000 + 9,000 + 10,000 + 13 158 = 41,158 rubles).

The amount of the single tax at the end of the year will be: (47,520 - 4,940 - 41,158 = 1,422 rubles), that is, the single tax was almost completely reduced due to insurance premiums paid for themselves.

Calculation of tax for the simplified tax system Income minus expenses 15%

The procedure for calculating advance payments and tax under the simplified tax system Income minus expenses is similar to the previous example, with the difference that income can be reduced by expenses incurred and the tax rate will be different (from 5% to 15% in different regions). In addition, insurance premiums do not reduce the calculated tax, but are taken into account in the total amount of expenses, so there is no point in focusing on them.

✐Example ▼

We will quarterly enter the income and expenses of the company Vesna LLC, operating on the simplified tax system Income minus expenses, into the table:

Advance payment based on the results of the 1st quarter: (1,000,000 - 800,000) * 15% = 200,000 * 15% = 30,000 rubles. The payment was made on time.

Let's calculate the advance payment for the six months: cumulative income (1,000,000 + 1,200,000) minus cumulative expenses (800,000 +900,000) = 500,000 * 15% = 75,000 rubles minus 30,000 rubles. (advance payment paid for the first quarter) = 45,000 rubles, which were paid before July 25.

The advance payment for 9 months will be: cumulative income (1,000,000 + 1,200,000 + 1,100,000) minus cumulative expenses (800,000 +900,000 + 840,000) = 760,000 * 15% = 114,000 rubles. Subtract from this amount the paid advance payments for the first and second quarter (30,000 + 45,000) and get an advance payment for the results of 9 months equal to 39,000 rubles.

To calculate the single tax at the end of the year, we summarize all income and expenses:

income: (1,000,000 + 1,200,000 + 1,100,000 + 1,400,000) = 4,700,000 rubles

expenses: (800,000 +900,000 + 840,000 + 1,000,000) = 3,540,000 rubles.

We consider the tax base: 4,700,000 - 3,540,000 = 1,160,000 rubles and multiply by the tax rate of 15% = 174 thousand rubles. We subtract from this figure the paid advance payments (30,000 + 45,000 + 39,000 = 114,000), the remaining amount of 60 thousand rubles will be the amount of a single tax payable at the end of the year.

For taxpayers on the simplified tax system Income minus expenses, there is still an obligation to calculate the minimum tax in the amount of 1% of the amount of income received. It is calculated only at the end of the year and is paid only in the case when the tax accrued in the usual manner is less than the minimum or is completely absent (upon receiving a loss).

In our example, the minimum tax could be 47 thousand rubles, but Vesna LLC paid in total a single tax in the amount of 174 thousand rubles, which exceeds this amount. If the single tax for the year, calculated by the above method, turned out to be less than 47 thousand rubles, then there would be an obligation to pay the minimum tax.

Tax on the simplified tax system 15% is calculated quite simply. It is important to correctly account for income and expenses, make advance payments on time and calculate the minimum tax at the end of the year to clarify the amount payable. In this article, we will explain how to calculate tax.

The tax rate may be less than 15% on the simplified tax system for the object "Income minus expenses"

Find out the tax rate that is set for your type of activity in your region: it can be noticeably lower than 15%. In 2016, in 71 constituent entities of the Russian Federation, the rate for the “Income minus expenses” object was reduced.

Advance payments on the simplified tax system 15%

Companies on the simplified tax system must make a “tax advance payment” on a quarterly basis: transfer an advance payment to the budget every quarter. The payment is calculated on an accrual basis from the beginning of the year and is paid within 25 days after the end of the quarter.

- For the 1st quarter - until April 25.

- For the 1st half of the year - until July 25.

- For 9 months - until October 25.

Based on the results of the year, the balance of the tax is calculated and paid, and a tax return is filed during the same period.

- LLCs do this until March 31st.

- IP - until April 30.

The minimum tax on the simplified tax system is 15%

Business does not always work in plus, and at the end of the year, expenses may exceed income or slightly differ from income. The tax base may turn out to be miserable or have a negative value. This does not mean that the tax payable will also be meager or zero. Based on the results of the year, it is necessary to calculate the minimum tax: it is calculated from all income received during the year, the tax rate is 1%.

So, at the end of the year, we calculate the tax in the usual way, additionally calculate the minimum tax - and compare these amounts. The amount that turned out to be more must be paid to the budget.

Accounting for income on the simplified tax system 15%

The income of an enterprise on simplified taxation is considered to be sales proceeds and non-operating income, their list is given in Art. and the Tax Code of the Russian Federation. Income on the simplified tax system is accounted for on a cash basis - upon actual receipt of money at the cash desk or to a current account. If an advance payment was received on the account or at the cash desk, and then it was returned, then the proceeds are reduced by the amount returned. Income is recorded in column 4 of section 1 of the KUDiR.

Accounting for expenses on the simplified tax system 15%

An exhaustive list of the enterprise's expenses for the simplified tax system is given in Art. 346.16 of the Tax Code of the Russian Federation. It includes the cost of acquiring fixed assets, tangible assets, paying salaries and insurance premiums, rent and much more. The company's expenses are entered in column 5 of section 1 of the KUDiR and are checked by the tax authorities for expediency. There is a procedure for accounting for expenses, according to which the costs must be directly related to the activities of the company, have documentary evidence, be fully paid and reflected in the accounting department. We already know what expenses and under what conditions fall into the category of expenses.

Tax calculation

The tax is calculated on the basis of the results of each quarter and the results of the year. It is necessary to sum up income from the beginning of the year to the end of the period of interest to us, subtract from this amount all expenses from the beginning of the year to the end of the period, then multiply the resulting amount by the tax rate.

If we calculate an advance payment for the 2nd, 3rd or 4th quarter, then the next step is to subtract the previous advance payments from the tax amount. Based on the results of the year, you also need to calculate the minimum tax and compare it with the amount of tax calculated in the usual way.

An example of calculating the USN tax 15% for the 4th quarter (at the end of the year)

We calculate the amount of tax payable at the end of the year:

(1,200,000 - 1,000,000) * 15% = 30,000 rubles.

Calculate the amount of the minimum tax:

1,200,000 * 1% = 12,000 rubles.

We see that the amount of the "regular" tax is greater than the amount of the minimum, which means that we are obliged to pay the "regular" tax.

We subtract from the tax amount at the end of the year the previous advance payments:

30,000 - 24,000 = 6,000 rubles.

This means that the balance of tax payable at the end of the year is 6,000 rubles.

The online service Kontur.Accounting automatically calculates advance payments and tax, generates payment orders, and reminds you of the payment deadlines. Get acquainted with the possibilities of the service for free, keep records, pay taxes, send reports using Kontur.Accounting.

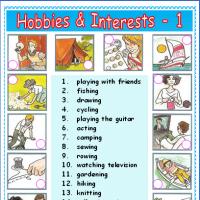

My Hobby - My hobby (1), oral topic in English with translation

My Hobby - My hobby (1), oral topic in English with translation Tattoo removal - how to remove at home without scars

Tattoo removal - how to remove at home without scars Squids: cooking secrets

Squids: cooking secrets Literature test on the topic "Black chicken or underground inhabitants" (Grade 5) Test work on black chicken

Literature test on the topic "Black chicken or underground inhabitants" (Grade 5) Test work on black chicken Soy Sauce: Uses, Benefits, Homemade Recipes

Soy Sauce: Uses, Benefits, Homemade Recipes Runetki mats Game bottle acquaintance communication

Runetki mats Game bottle acquaintance communication Why did Chekhov call The Cherry Orchard a comedy?

Why did Chekhov call The Cherry Orchard a comedy?