Opening a bank account for a bankrupt organization. How to open an account with Sberbank for a legal entity. How to open an account

For citizens engaged in commerce, the procedure for opening an account / accounts in a banking institution is mandatory. This is stipulated by the law of the Russian Federation. Open an account with Sberbank for legal entity simple enough. You need to know a few nuances that will help you complete this operation quickly and without problems.

What is a checking account

The presence of such a tool allows you to make transactions, buy the necessary goods, pay salaries to company employees, and much more. Doing all this remotely is much more convenient and comfortable. Many prefer to cooperate with Sberbank. This financial and credit institution has an excellent reputation and trust among customers.

Documents to open

Sberbank allows you to open a current account when a legal entity provides the necessary papers (a package of documents). Before you go to the branch of the organization, it is recommended that you familiarize yourself with the conditions and programs on the official website of the bank http://www.sberbank.ru/ru/person

It will also provide information on current promotions and tariff plans. To complete the account opening operation, you will need the following documents:

- Constituent documents of firm;

- A document that confirms registration at the state level;

- Individual taxpayer number;

- Extract;

- A paper that confirms the company's tax registration;

- Confirmation from the state statistics;

- Questionnaire. Filling examples are available at the bank;

- If necessary (based on the type of activity of the company) - licenses;

- Certificates and documents that confirm the powers of the chief accountant or manager;

- Sample signatures of the head and accountant and seals.

As a rule, clients submit original documents. The bank makes certified copies. You can use photocopies of documentation, having previously certified them with a notary.

These are all the documents that you need to bring in order to open an account with Sberbank. Next, the identification procedure will be carried out, followed by the conclusion of the contract. The most difficult thing in this process is the sufficient availability of free time. Since visiting a bank branch is mandatory.

When to open a current account and what parameters to consider a financial institution

Completion of the operation

A bank employee must check (identify) a legal entity and process the received data. The procedure is carried out on the basis of documents that were transferred to the organization (bank). In most cases, opening an account with Sberbank for a legal entity does not require additional documents. However, this happens in individual situations. You need to be prepared for this in advance.

The last step is the signing of the contract. The procedure is performed by an organization (legal entity) and a bank. Everything is confirmed by the seals of both institutions. After that, an employee of a financial and credit company creates an account in the registration book. Opening an account with Sberbank for a legal entity is no longer a problem. It is registered and can fully function.

It is important to remember that information regarding opening an account must be sent to the tax service, social insurance authorities and the Pension Fund.

The operation must be completed within 7 days (weeks). It is preliminary recommended to clarify whether we are talking about working days or calendar days. Otherwise, an unpleasant situation may arise.

Opening an account for a legal entity online

This procedure is available to every client of the bank. Especially when there is no time to go to the bank office. Many leaders face this problem. The remote registration function will save time and fill in the necessary data without leaving the workplace.

However, it will not be possible for a legal entity to register an account with Sberbank in this way. The remote option only allows you to reserve a seat. The manager will still need to visit the branch within the next five days. This approach is justified if at the moment there is no opportunity to personally go to the bank, but it is necessary to open an account. You need to take the following actions:

- Click on the Small Business tab on the site and use the Banking link;

- Select the section Opening and maintaining accounts;

- Click on the button Online current account number.

Thus, virtual registration is performed. You can open an account with Sberbank online only in this way. You will need to enter all the necessary and required information by the system.

The reserved account will have limited functions until the client visits the bank branch in person. In particular, you can not conduct financial transactions. Such an account only allows you to receive funds transferred to it.

Conclusion

Opening an account with Sberbank for a legal entity is quite simple. Knowing what documents you need to prepare by reserving an account online, this procedure can be done much faster.

Through its cash settlement program, Sberbank offers corporate clients the opening and maintenance of current accounts. Thanks to an extensive network of bank branches in the territory Russian Federation and beyond its borders, cooperation with foreign and domestic contractors became possible.

Opening an account with Sberbank is very attractive for a legal entity. This lending institution good reputation and has a simplified billing system. Non-cash payments are preferred when conducting business transactions in the national and foreign currency. The state gets the opportunity to control the movement of funds of a business entity.

Organizations get the right to register multiple accounts with different purposes. When carrying out foreign economic activity, it is permissible to use various settlement operations: letter of credit, bank transfer and collection.

Opening a current account

To open an account with Sberbank for a legal entity, you can use one of the following methods:

The list of documents for submission to the institution is posted on the official resource of the bank. The main ones are:

The list of documents for submission to the institution is posted on the official resource of the bank. The main ones are:

If documents for opening an account with Sberbank for a legal entity are provided in originals, they must be certified by a representative of a financial institution. Notarized copies are also accepted.

Having accepted the provided package of papers for consideration, the bank's specialists prepare a design contract with explanations of the asset management process, according to instructions for the transfer of funds. The document is supplemented with recommendations on banking services and provided tariffs. The agreement includes information on the liability of the parties in case of force majeure and the procedure for resolving disputes that have arisen. As soon as the agreement is signed by both parties, the organization receives the status of a full-fledged client of a financial institution.

Online account opening

Understanding how valuable the speed of decision-making is in our time, the bank provided for how to open a current account for a legal entity in Sberbank online. The client representative will need to familiarize himself with the proposed service tariffs in advance, fill out the appropriate application on the official resource of the institution. The account will become available for use after receiving notification of its creation.

Understanding how valuable the speed of decision-making is in our time, the bank provided for how to open a current account for a legal entity in Sberbank online. The client representative will need to familiarize himself with the proposed service tariffs in advance, fill out the appropriate application on the official resource of the institution. The account will become available for use after receiving notification of its creation.

To save an account, you will need to bring the necessary package of documents to the bank within five days. If this is ignored, the open account with Sberbank for a legal entity will be canceled. The money will be returned to the owner.

Developed many convenient services for their clients. It serves as a prime example. The credit organization has created a developed customer support. On the page you can read in detail what opportunities a call to the hotline provides.

The choice of a financial institution in which the organization will be serviced must be approached with all seriousness, because, unlike individuals and entrepreneurs, organizations are not provided with deposit insurance that guarantees the safety of the enterprise's funds. The difficulty lies in opening a current account in a reliable bank that provides a convenient service for a minimal fee. Open an account with Sberbank for a legal entity - optimal choice when it comes to the safety of funds and the stability of work.

As part of Sberbank's offer, several service programs are provided, and the cost is determined by the breadth of services provided and their volume.

Advantages and disadvantages of opening an account with Sberbank

Unlike smaller and younger banks, Sberbank does not offer exclusive terms to attract new clients from legal entities. At the same time, for organizations interested in a full-fledged long-term partnership, service in the largest bank is a guarantee of the safety of trusted capital and stable operation.

Before you open an account with Sberbank for a legal entity, you need to study the programs offered, because the prices for the services of a financial institution are far from the most favorable.

If, in conditions of instability in the banking sector, the client is interested in a guarantee of reliable preservation of funds and secure transactions and orders, it makes sense to consider Sberbank, whose founder is the Central Bank of the Russian Federation. In an environment where news about the revocation of licenses from banks is becoming daily, one should seriously think about the degree of trust in a financial institution.

The positive characteristics of cooperation with the bank are:

- the widest representation in the regions;

- affordable and profitable lending schemes for small businesses;

- established international relations with servicing in subsidiary financial institutions in the CIS countries and far abroad;

- currency accounts are opened within 1 business day.

At the same time, the position of the bank in various ratings is very different: if official statistics indicate its leading position, then according to customer reviews, the situation is less attractive.

Considering the national rating, it is necessary to understand that it is difficult to achieve complete customer satisfaction, and the existing tariffs are especially significant for entrepreneurs whose activities are not distinguished by high incomes. For those who have decided to open an account with Sberbank for a legal entity, full information is available online about the tariffs in force in each region of the Russian Federation and the list of required documents.

Tariffs in Sberbank for legal entities

For an enterprise engaged in commercial activities, one of the most important performance indicators is the profitability of the business. For this reason Special attention paid to the cost of banking services and related costs that ensure the financial activity of the company. It is important for a business owner to study the possibility and conditions for performing various operations, including opening an account for an LLC in Sberbank and further settlement and cash services.

You can find information about upcoming expenses on the official Internet resource of a financial organization by selecting the section for legal entities and clicking on the banking services tab. All the necessary information is presented on the page on opening and maintaining accounts.

Each of the offers provides special conditions suitable for the different needs of organizations.

Varying from region to region, tariffs for current packages take into account:

- actions to open an account for an LLC in Sberbank;

- regular account management;

- execution of payment orders (by the number of operations performed);

- commission and conditions for cashing out funds (as a percentage, not less than the specified threshold);

- preparation of extracts.

There is no unequivocal answer about the greatest benefit for legal entities when servicing at Sberbank. For one organization, comfortable service is important for mutual settlements with domestic companies and clients, while another is more concerned about the question of how to open a foreign currency account with Sberbank and what are the parameters for working with foreign accounts.

In 2018, the following rates are set for LLCs operating in the Moscow Region:

- Opening an account - 2.6 thousand rubles.

- Cash settlement fee - 2.1 thousand rubles / month.

- The fee for 1 operation of crediting to an account within the bank is 12 rubles, to external structures - 45 rubles for 1 transaction.

- Payments to government departments, tax - no commission.

- Acceptance of cash through terminals - 0.5%.

- The cost of cashing out depends on the volume - 3-8% of the amount.

In February 2018, a new package was introduced to provide an easy start to banking for organizations. Many options within this package are available for free:

- open an account;

- maintain a ruble account and use the Internet system "Business Online";

- transfers to other legal entities within the bank;

- three transactions to organizations, using details in other financial institutions (other payments are made with a charge of 100 rubles per transaction);

- maintenance of corporate plastic in the 1st year.

When depositing cash using terminals, they charge 0.15% of the amount. Only LLCs with a single account within the same territory can connect the package.

The procedure for opening a current account with Sberbank for an LLC is regulated by Instruction No. 153-I, introduced by the Central Bank of the Russian Federation in 2014. The list of documentation required for submission to the branch can be found on the pages of the official website of the financial structure.

If desired, the legal entity has the opportunity to reserve a current account without waiting for the completion of the registration and verification of papers. To do this, use a convenient online service that allows you to get the details before visiting the office.

When data on a current account is required urgently and there is not enough time for complete registration, Sberbank allows you to obtain data so that the organization can receive funds to the account. It is enough just to fill out the proposed form on the website, entering the details of the LLC and choosing the branch where the service is supposed to be. The client has 30 days to prepare a package of papers and apply to the branch. If funds were credited to the specified details, the period for finalizing the account is reduced to 5 days.

A bank that offers reliability and stability is very attentive to the package of documents that make it possible to judge the reputation of a potential client.

The list of papers that will be needed to open an account with Sberbank includes:

- Statement.

- Statutory documents.

- Certificate and extract from the Unified State Register of Legal Entities.

- A document confirming that the organization is a taxpayer and is registered with the Federal Tax Service.

- A card that establishes samples of legitimate signatures and seals.

- Information about the legal entity in the form of a bank.

- List of documentation establishing the election of the officials listed in the card and their powers.

- Documentary confirmation of the powers of the sole body.

- Personal documents for persons authorized to manage financial flows and give orders for transactions with funds on the account.

- If necessary - licenses, permits for activities.

Additionally, a package of papers is prepared for the authorized person involved in opening the account: a notarized copy or original of the power of attorney from the organization and a personal document (original civil passport).

Every legal entity and most companies have to open a current account. individual entrepreneurs. Even if your business manages only in cash, for an LLC it is allowed to pay taxes to the budget only in a non-cash way. Sberbank is the largest bank in the country, including in terms of the number of corporate clients served. In order to be serviced at Sberbank for a legal entity and an individual entrepreneur, it is required to collect a package of documents.

Documents for opening a current account with Sberbank

The list of required securities in different banks may vary. For example, d for LLC Sberbank asks for a bulk package.

Documents for the account in Sberbank:

- Constituent documents of legal entities (Charter and / or Memorandum of Association). You can provide originals or notarized copies.

- Certificate of state registration of a legal entity and / or certificate of making an entry in the unified state register of legal entities. Original required.

- Certificate of registration with the tax authority. The original is provided, from which an authorized employee of Sberbank can make copies.

- Extract from the Unified State Register of Legal Entities. The original or a notarized copy will do. It is also allowed to submit a copy made through the service of the tax service and signed with an enhanced qualified electronic signature of the Federal Tax Service. For legal entities registered for less than 1 month, instead of an extract from the Unified State Register of Legal Entities, an Entry Sheet in the form P50007 can be submitted.

- Card with samples of signatures and seal imprint. The card must be notarized. Another option is to get a card directly at the bank with the personal presence of all the persons indicated on it.

- Information information of the client in the form of the bank. The form must be downloaded from the Sberbank website.

- Documents confirming the authority of the persons indicated in the card to manage the account. The term of office must be reflected. Originals or notarized copies are submitted.

- Documents confirming the powers of the sole executive body of the legal entity, including the extension of the term of office. Original or notarized copy.

- Documents proving the identity of the persons indicated in the card. Originals required.

- Licenses (permits) - if the activities of the LLC are subject to licensing.

- License to work with state secrets (if any).

- If it is planned to open a current account for an LLC through a representative, then a power of attorney is required to confirm his authority, as well as an identity document.

- If the client connects to the E-invoicing service and submits an application for a qualified electronic signature key, it is additionally required to submit SNILS (insurance certificate of compulsory pension insurance).

Reservation of a current account in Sberbank

As you can see, opening a current account with Sberbank for LLCs and individual entrepreneurs is not so simple. It is necessary to collect documents in advance, almost immediately after the registration of the company. While preparing the documents, you can use the service of reserving a current account. Sberbank offers to reserve an account through an online service posted on the website. You will be able to receive the details of your future account in 5 minutes.

A reserved account can only work for crediting funds, you will not be able to withdraw money. Within 30 calendar days from the date of reservation, you must submit all documents to the bank. If the bank considers the documents to be correctly executed, then the reserved account will become a full-fledged settlement account. You will be able to manage all the accumulated funds, perform any banking operations.

If you have not provided a set of documents within 30 days, then the reserved account will be canceled, and the cash returned to senders.

Sberbank tariffs and service packages

Of course, one of the key points when choosing a bank is account opening fees and subsequent settlement and cash services. In the table below, we have reviewed the most popular Sberbank service packages with current prices as of January 1, 2017. The information concerns the city of Moscow. The cost of services may differ in other regions.

| Package "Salary" 4800 rubles/month | Package "Minimum" 1700 rubles/month | Package "Basis" 3100 rubles/month | Package "Asset" 3200 rubles/month | Optima package 4100 rubles/month |

| Internet banking using the Sberbank Business Online system up to 30 payment orders per monthCash withdrawal up to 200,000 rubles per monthTransfer of funds to the accounts of individuals under a "salary" agreement | Internet banking using the Sberbank Business Online system up to 5 payment orders per month Acceptance of cash up to 50,000 rubles per month | Internet banking up to 10 payment orders per month Acceptance of cash up to 80,000 rubles per month Cash withdrawal up to 140,000 rubles / month. | Internet banking up to 20 payment orders per month Cash acceptance up to 300,000 rubles. Cash withdrawal up to 100,000 rubles. | Internet banking up to 30 payment orders per month Cash acceptance up to 150,000 rubles. Cash withdrawal 250,000 rubles. |

Advantages of Sberbank

- High reliability of the bank. In conditions of economic instability, bank closures are not uncommon. Since the beginning of 2016, the licenses of more than 70 banks have been revoked in Russia. You will not envy the clients of these banks, since it is very difficult for them to return their own funds. Opening an account for legal entities with Sberbank can become a guarantee against sudden bankruptcy. The largest bank in the country will not lose its license.

- Wide branch network. Sberbank is the leader in terms of the number of branches and affiliates. This is a bank within walking distance. Even abroad, you can use its services.

- Sberbank provides advice and support on foreign economic activity. Opening a currency account on the same day is not a problem.

Disadvantages of Sberbank

- Cost of services. Opening a current account for an LLC in Sberbank will be more expensive than in many other banks. The cost of service packages is higher than similar conditions offered by competitors. There are commissions for internal transfers, unfavorable exchange rates, etc.

- Sberbank is reluctant to work with small businesses, it is interested in large clients. Opening an account for a small LLC may be denied.

- Sberbank, as a very large financial structure, is inert. Quite a lot of bureaucracy. The package of documents for opening an account is “bloated”. When servicing legal entities, queues are not uncommon.

- Sberbank lacks flexibility and an individual approach to the client. Today, many banks offer the client to create his own personal package of services, which includes only those operations that are really needed.

- The current account can be unexpectedly blocked if the operations you performed seemed suspicious to the bank employees. Unblocking is a long and tedious process.

- There is a technical problem. Users mainly criticize Sberbank-Online for the lack of full-fledged account management.

Summary

In the article, we tried to talk about all the main points that accompany opening an account with Sberbank. Whether to follow our recommendations and where to open is, of course, up to you. In any case, you should not rely on “luck” or the opinion of one or two people. Carefully analyze and compare tariffs, terms and conditions of different banks. Read reviews on the Internet, chat with bank employees. These actions will help you make the right decision and choose exactly the bank with which it will be pleasant to cooperate.

This article is the first of three that talk about the most popular banks for opening a current account. Read also our articles about and bank.

How to open a current account with Sberbank for a legal entity and individual entrepreneur updated: November 30, 2018 by: All for IP

For all legal entities engaged in commercial activities, the opening procedure bank account(one or more) is mandatory at the legislative level. Besides non-cash payments significantly speed up payment transactions and optimize the workflow. With the help of a current account, a company can make payments wages employees, pay for purchases, make tax deductions, and accept cash for services provided. Therefore, as soon as the registration of a legal entity takes place, the company immediately needs to start opening an account with a trusted and reliable bank.

Among such banks, Sberbank occupies a special place - an institution with an impeccable long-term reputation, time-tested, which justified the trust of its customers. To have an idea of how to open an account with Sberbank for a legal entity, it is recommended to visit the official website for informational purposes. There you can also find out about current tariff plans, advantageous propositions, promotions.

Required documents for opening an account

The list of documents required for legal entities to open an account with Sberbank:

- statutory or constituent documents of the company;

- a certificate confirming the state registration of a legal entity;

- TIN of the enterprise;

- extract from the Unified State Register of Legal Entities;

- certificate from the tax service on the registration of the company;

- confirmation from government statistics;

- a questionnaire filled out according to the model established by the bank;

- supporting documentation on the powers of the head or chief accountant;

- a special card containing an imprint of the company's seal, samples of personal signatures of officials;

- licenses - if the company's activities require it.

Note: originals of all documents are provided, and bank employees make copies and certify them. You can also provide a package of photocopies certified by a notary.

Identification and conclusion of the contract

Before opening an account, a bank employee will carry out a procedure for identifying a legal entity, processing the data provided. Verification of information is carried out on the basis of the documents provided. Usually the manager does not need to bring any additional information.

This is followed by the stage of the conclusion of the contract. The document is signed by representatives of Sberbank and the organization, and also sealed by both parties. Further, the bank employee creates an account in the registration book - the opening of an account for legal entities in Sberbank can now be considered completed.

Note: within a week, a legal entity should be sure to transfer information about opening a current account to the tax service, pension fund and social insurance authorities.

Online reservation service

To improve the quality of customer service, Sberbank has developed additional option, which allows you to remotely reserve a place on the official portal of the bank. This operation will be convenient if the manager does not currently have the opportunity to personally contact the branch to open an account.

Click on the "Small Business" or "Banking" tab

"Online current account number"

The essence of the service is virtual registration. The director or chief accountant fills out an electronic questionnaire, enters all the relevant data. This is followed by the stage of information processing, the procedure for identifying the company. In parallel, a Sberbank employee creates a current account number and sends a notification to the client with the information.

The account number reserved in this way will be valid for five days. At this time, the company is not yet able to fully complete all financial transactions, only to receive funds.

But do not forget that within the same 5-day period you must come to the Sberbank branch in person and provide a complete package required documents. Only then will the procedure for opening a current account be considered completed, and it will be possible to carry out all debit transactions. If it didn’t work out for 5 days to find time to complete the full activation, then there is no reason to panic. The reserved account number is simply canceled, and all funds that have been credited in time will be returned to counterparties. After that, you can re-register online or open a current account with Sberbank.

Account opening services are provided on a paid basis. But there is also the possibility of a free opening - usually an employee of Sberbank informs about these nuances and conditions. But on general rules, you will need to connect an additional service to the online reservation. In addition to opening an account for free, a legal entity will have the opportunity to be serviced remotely, which significantly helps to save time.

Does ureaplasma pass by itself (can it pass on its own)?

Does ureaplasma pass by itself (can it pass on its own)? PCR analysis to detect chlamydia Chlamydia PCR how to do

PCR analysis to detect chlamydia Chlamydia PCR how to do COCs with different daily dosages: how to choose, an overview of the best drugs

COCs with different daily dosages: how to choose, an overview of the best drugs Ureaplasma parvum: characteristics, tests, symptoms in women and men, what is dangerous, whether it is necessary to treat

Ureaplasma parvum: characteristics, tests, symptoms in women and men, what is dangerous, whether it is necessary to treat Basic technologies for obtaining nanomaterials

Basic technologies for obtaining nanomaterials How to tell the time in English?

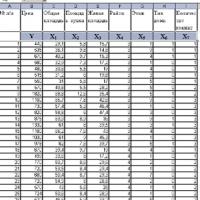

How to tell the time in English? Introduction to Multivariate Statistical Analysis

Introduction to Multivariate Statistical Analysis