Sberbank car loan. Sberbank car loan. Requirements for borrowers and required documents

The new Sberbank car loan calculator or car loan calculator is a universal car loan calculator designed for online calculation of a car loan at Sberbank, and also calculates car loans from other banks.

Car loans, conditions and interest rates in 2019

Currently, Sberbank of Russia offers one car loan program, below are car loan conditions and interest rates for 2019.

MAIN TERMS OF A CAR LOAN IN SBERBANK:

* In Sberbank, you can get a car loan without a down payment, without a certificate of income and employment according to two documents, subject to a down payment of 50%.

Car loan with state support 2019 - a list of cars

A car loan with state support, under the program of preferential lending, in Sberbank can only be issued for a new domestic car or a foreign car, provided that the car is assembled on the territory Russian Federation. Sberbank does not provide car loans for used used cars.

CONDITIONS OF PREFERENT CAR LOANS IN 2019-2020

* To get a car loan with state support, you must have a driver's license and the absence of contracts concluded during the year for the purchase of other cars on credit.

The program of preferential car loans (car loans with state support), by decision of the Russian government, has been extended until 2020. Inhabitants Far East will receive an increased discount - up to 25% of the cost of the purchased car. The total amount of funding for the program is 15 billion rubles.

FOR CONCLUDING A LOAN AGREEMENT YOU SHOULD PROVIDE:

- Contract of sale of the purchased vehicle (TC);

- Payment document of a car dealership for payment for the purchased vehicle;

- A copy of the vehicle passport (PTS);

- Insurance policy / insurance contract against the risks of loss, theft and damage;

- A document confirming the payment by the borrower/co-borrower of the down payment;

- A document confirming the payment of the insurance premium (except for cases of inclusion in a loan);

- Invoice for payment of the insurance premium (if the insurance premium is included in the loan amount).

* Before applying for a car loan to a bank, we advise you to familiarize yourself with the terms and conditions online.

Credit products of Sberbank of Russia

- Credit cards

- Offers for business

- Offers for pensioners

Loan calculators

* Information on the site is not a public offer! The results of the calculation may differ slightly from the data provided by the bank when applying for a loan. For more information, check with the branches of the Security Council of the Russian Federation.

Not everyone can afford to buy a new car, which updates offers with car loans from reputable banks. An interest calculator will help you choose a car loan at Sberbank in 2019, which accurately determines the best offers and the monthly payment at the tariff rate. The variability of offers to individuals from the largest bank in Russia and the presence of additional shares from third-party companies make the selection of a car loan a responsible task that requires studying all the pitfalls to work best choice.

In 2019, loan offers were revised, improving conditions for customers. Such a policy makes us think about the choice of lending services in Sberbank. The Bank provides not only preferential conditions, but also cooperation with manufacturers of domestic cars and foreign cars, offering shares for a certain the lineup. Basic conditions for all offers are as follows:

- minimum interest rate – from 10.9%;

- loan term from 3 months to 5 years;

- the minimum contribution is 15% of the cost of the purchased vehicle. There are offers without a down payment;

- for a loan, rubles, dollars and euros are offered.

You can calculate the loan in detail using the online calculator available on the Sberbank website. This way you will accurately determine the amount of the monthly payment and the interest rate. The calculator interface prompts you to enter the following data for processing:

- the cost of the purchased vehicle;

- the amount of the down payment that you are able to make;

- the currency used;

- loan term and interest rate;

- date of first payment.

The system will process and systematize the information, providing accurate data and monthly statistics. First you need to familiarize yourself with the main offers for a car loan.

Main loan programs and their conditions

To date, there are 3 popular car loan programs:

- standard;

- affiliate;

- preferential.

The standard solution is relevant for the sum of the cost of the car from 45 thousand to 5 million. The interest rate here is from 15 to 17 percent, and the repayment period is from 3 months to 5 years. Existing customers of Sberbank can get a 1% discount, which is a nice addition to the conditions. The standard down payment is 15% of the car's value, but the bank offers an option without a fee. You need to provide a copy of the insurance of the purchased vehicle and fill out documentation confirming the provision of the vehicle as collateral.

The partnership option applies to the purchase of certain models in official car dealerships, offering a lower interest rate and the availability of a variety of promotions, which the Sberbank website allows you to track online.

The benefit program offers government subsidies. Let's consider this issue separately.

Sberbank car loan with state subsidies - 2019

Subsidies are issued for the purchase of new cars worth up to a million. If the vehicle costs less than 750 thousand, you need to pay 85% of the cost, the rest of the debt is paid by the state. The maximum term of this offer is 3 years. The interest rate is 8-10%, but it is not fixed. Interest is regulated by refinancing. Great deal available to everyone individuals, including pensioners. The promotion applies exclusively to models of domestic manufacturers.

How to get a car loan for pensioners

Loan conditions for pensioners differ little from the usual ones. Required to provide:

- a copy of the passport;

- a copy of the driver's license;

- income statement;

- a statement drawn up according to a special sample of Sberbank.

Together with the passport, you must provide a copy of the pension certificate. Up to 65 persons are allowed for lending at the time of conclusion of the contract. With a down payment of more than 30%, the bank will not require guarantors.

Sberbank recommends purchasing cars from the showroom. In this case, you will receive not only a new vehicle at favorable conditions, but also an additional guarantee, insurance and further service maintenance. The Bank supports the development of the domestic automotive industry by reducing the interest rate and helping to repay 15% of the cost of transport.

By choosing a Sberbank car loan with an interest rate in 2019, the calculator will help you choose best option. Please check current offers and additional terms and conditions of the loan beforehand. Sberbank is known for its advantageous offers and is in demand by residents of Russia.

If you want to buy a car in the MAS Motors showroom, you can borrow funds from one of more than thirty partner banks, including Sberbank.

Sberbank is one of the largest and oldest banks in Russia. It was founded in 1841 (more than a century and a half ago) and currently has a client base of over 110 million people (only in Russia).

Loan products

A distinctive feature of Sberbank loans is their versatility. You do not have to prescribe the purchased car as a security (pledge) in the contract. You will simply be transferred the required amount, which you can dispose of at your discretion.

Funds can be obtained through one of the lending programs indicated below:

- Unsecured loan

- Under the guarantee of individuals

- secured by real estate

- Refinancing

Depending on the age, income of the client and other nuances, the parameters of loans can have the following values:

The advantages of Sberbank loan products can be summarized as follows:

- You can receive money directly at the place of residence or at any other branch of the bank (that is, in almost any locality, regardless of the place of registration);

- No initial deposit required;

- If you do not have enough to buy a certain amount, the amount of borrowed funds can be precisely adjusted to the missing (provided that your earnings allow it);

- No car deposit required;

- Vehicle insurance is not required (if desired, the amount of CASCO or similar insurance can be included in the loan amount, and the insurance contract can be concluded with a third-party company later without any recommendations or obligations to Sberbank).

With the help of refinancing, for example, you can remove the encumbrance from a car purchased from another bank (that is, completely redeem it), reduce the payment, and even receive an additional amount for your own needs.

Not only apartments or private houses in possession, but also car garages, summer cottages, land plots can be considered as real estate.

Third party guarantee increases the potential loan amount (because the bank risks less).

The interest rate depends on the term of the loan, the amount of the loan, as well as the category of clients (salary card holders and corporate clients are offered more favorable conditions).

The term for consideration of the application depends on the amount of the loan and its type. So, for a loan without collateral, the decision may take only a few hours, and for a loan with real estate collateral, the process can take up to 8 days. However, customers connected to the SberbankOnline service can apply through Personal Area or take advantage of a personal offer (the bank periodically sends pre-approved offers calculated on the basis of monthly income to the salary account).

Requirements

Loans are issued to all citizens of the Russian Federation who have reached the age of 21, residing in any locality. For employees with temporary registration, the loan period may be limited by the period of registration. In some cases, a loan can be issued to persons aged 18 to 20, subject to the obligatory guarantee of another solvent client (for example, one of the parents).

The maximum age of the recipient is 65 years (calculated at the time of loan repayment). For working pensioners and those who can document their income, the bar can be raised to 75 years.

At the last place of work, the borrower must work for at least 6 months, and for the last 5 years, the work experience cannot be less than 1 year.

Reduced requirements are imposed on users of payroll projects (for example, confirmation of work experience is not required, at least 3 salary receipts are sufficient).

Documentation

As with any other bank, to get a loan you need:

- Passport of a citizen of the Russian Federation,

- Income proof documents

- Copy of work book.

Customers who are holders of payroll cards can only take their passport with them to apply.

Guarantors provide the same set of documents as the recipient.

The online car loan calculator of Sberbank of Russia will help you calculate the overpayment and monthly payment for popular bank lending programs. Choose the most favorable credit conditions by calculating the overpayment for different banks.

At the moment, Sberbank has three auto-lending programs. The main program provides for a loan of up to 5,000,000 rubles for a period of up to five years. The interest rate for this program varies from 13.5% to 16%, depending on the amount of the down payment and the loan term.

In addition to the basic program, Sberbank offers customers other, even more favorable conditions. The Bank actively cooperates with dealer centers of manufacturers. When buying a new car in one of them, you can get a car loan at a significantly lower rate.

Car loan programs of Sberbank of Russia:

Note! You can change the calculation parameters (namely, the cost of the car, the interest rate, the loan term, the size of the down payment) in the left window "loan parameters".

How to calculate a car loan in Sberbank of Russia?

In order to calculate the overpayment on a car loan at Sberbank, fill out the form in the upper left corner of the page. For the accuracy of the calculation, you need to know the interest rate on the loan, the cost of the car, the amount of the down payment in ruble equivalent, the required loan term.

Enter these data into the car loan calculator and click the "calculate car loan" button. Within a couple of seconds, the application will automatically process the received data and issue a three-dimensional report.

- The total amount of the overpayment.

- The amount of the monthly loan payment.

- The total cost of the car (price + overpayment).

- A tabular payment schedule with a monthly indication of payments and the balance of the debt.

The Sberbank car loan calculator is a convenient and simple program that will allow you to calculate how much you will have to pay on a loan taken, how much a client can expect at a certain income level. Such programs are available on the websites of almost all major credit organizations, but in Sberbank it has additional features for calculation. However, you need to remember that the calculator will not help to accurately calculate a car loan at Sberbank: when calculating the final rate, different factors and different interest rates can be charged on the same amount.

How to calculate a loan using a calculator?

Sberbank car loan calculator offers three calculation options: by the amount of income, by the amount of the loan and by the amount of payment that the client is willing to make every month for the entire period. This is very convenient: in a few seconds you can get information about whether it is worth contacting the bank and what loan amounts you can count on. Learn more about how to calculate a loan using a calculator:

- A car loan calculator from Sberbank allows you to determine how profitable the loan will be. To do this, the cost of the car, the amount of the first installment (at least 15%), and the period during which you intend to pay are driven into the program fields. The interest rate on the loan depends on the term: if the loan is taken for a year, it will be 14.5% per annum, 2 years - 15.5%, 3 years or more - 16%. On the right, you will see the result of the calculation: a payment schedule will be shown, and it will be indicated how much is spent on paying the principal debt, and how much is repaying bank interest. The amount of the monthly payment and the overpayment that this loan will require will also be indicated.

Calculation example: the buyer chooses a Volkswagen car in the salon, the cost of which is 750,000 rubles. A loan through an application from a car dealership is issued for 3 years, the initial payment is 112,500 rubles. (15% of the cost). Every month, the client will have to pay 22,255.56 rubles, the overpayment on the loan will be equal to 163,700.12 rubles.

- The car loan calculator at Sberbank also allows you to calculate the loan by the level of the client's salary. Sberbank takes into account only official income, confirmed by a 2-personal income tax certificate, it is also possible to involve a spouse as a co-borrower, so the total income of the whole family can also be taken into account in calculations. The calculator indicates the amount of income, as well as the period for which you are going to take a loan.

Example: The total income of the Ivanov family is 45,000 rubles. They are going to take out a loan for a car for a period of 4 years. In this case, the rate will be equal to 16% per annum. The maximum loan amount in this case will be equal to 952,707.57 rubles, the monthly payment will be 27,000 rubles.

- The third option - a calculator for a car loan in Sberbank will allow you to calculate a loan if possible monthly payments. The calculation is based on how much the client is willing to pay each month. It also depends on the level of income, since the loan payment should not exceed 40% of the salary. The program enters data on payments and on the period for which the client plans to borrow funds.

Example: Citizen Ivanov is ready to pay 15,000 rubles every month and wants to take a loan for a car for 5 years. The maximum loan amount in this case will be 616,825.59 rubles, the rate is 16% per annum. With such a value interest rate over 5 years, an overpayment in the amount of 283,174.38 rubles will accumulate, that is, almost half of the cost will have to be overpaid for the car.

In any case, the Sberbank car loan calculator calculates only approximately. Some conditions may lower or raise the rate, so it is better to contact the bank and ask for a form with an accurate calculation.

Can you save money on a loan?

The Sberbank car loan calculator can be used to see how much you can reduce the overpayment, subject to several conditions. Sberbank has several special offers aimed at various groups of borrowers and certain brands of cars. A car loan using the Sberbank calculator can be calculated even before applying, so you can decide in advance on the most profitable loan option.

There are several options to help you save on car loans:

- It is especially profitable to take a loan from Sberbank if you receive a salary or pension in it. In this case, the rate is automatically reduced by 1%, and the documents will be much easier to collect. This is easy to explain: the bank can track the movement of money in your accounts, which means it will easily form an idea of your solvency.

- The overpayment can be significantly reduced if you make a large down payment with a decrease in the loan term. In this case, the debt will be somewhat more difficult to pay off, as monthly payments will increase, but the rate will be lower, and as a result, you will not have to pay a large amount to the bank.

- You can save money by purchasing cars in showrooms under special programs. Through the website of the official dealer of this brand, you can find out if Sberbank is a permanent partner. In this case, the rate can be reduced by several percent at once, and the loan will be more profitable.

- A bad credit history always increases the interest rate on a loan. Even if the bank issues a loan, it will still insure itself against possible risk, so the overpayment will be much larger.

Sberbank Online is a loan calculator for a car loan that will allow you to calculate in advance how and on what you can save. The site is available at any time, and it is better to find out in advance about all the opportunities offered by the bank.

Sberbank is one of the most reliable credit organizations, but it also makes the highest demands on its borrowers. It offers loans for all brands of domestic and foreign vehicles, lending for used cars is available.

Does ureaplasma pass by itself (can it pass on its own)?

Does ureaplasma pass by itself (can it pass on its own)? PCR analysis to detect chlamydia Chlamydia PCR how to do

PCR analysis to detect chlamydia Chlamydia PCR how to do COCs with different daily dosages: how to choose, an overview of the best drugs

COCs with different daily dosages: how to choose, an overview of the best drugs Ureaplasma parvum: characteristics, tests, symptoms in women and men, what is dangerous, whether it is necessary to treat

Ureaplasma parvum: characteristics, tests, symptoms in women and men, what is dangerous, whether it is necessary to treat Basic technologies for obtaining nanomaterials

Basic technologies for obtaining nanomaterials How to tell the time in English?

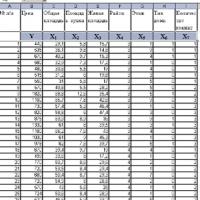

How to tell the time in English? Introduction to Multivariate Statistical Analysis

Introduction to Multivariate Statistical Analysis