Types of production processes and impact effects. Internal audit of the production process. Internal audit of the production process The purpose of controlling the production cycle and costs is

Send your good work in the knowledge base is simple. Use the form below

Students, graduate students, young scientists who use the knowledge base in their studies and work will be very grateful to you.

Posted on http://www.allbest.ru/

Kostanay Social and Technical University

named after academician Z. Aldamzhar

Faculty of ECONOMICS LAW AND MANAGEMENT

Department of Economics and Management

Coursework in the discipline AUDIT

TOPIC: CYCLE COST AUDITPRODUCTION

Completed by: Nasaratullina Arina Radikovna

2 specialty courses

Accounting and audit, open source software

scientific adviser

Moshchenko N.S.

Senior Lecturer

Kostanay

Introduction

1. Theoretical aspects of accounting for the production cycle

1.1 Organization of production and production accounting at the enterprise: general provisions, classification of production costs

1.2 Documentation, accounting and distribution of material, labor and financial resources spent in production

2 Consolidated accounting and audit of production cycle costs

2.1 Synthetic and analytical production costs

2.2 Audit of the production cycle: the relationship of accounts, verification procedures

Conclusion

List of used literature

Introduction

Production is a fundamental process in the economic activity of an organization. This process affects the financial result of the organization, i.e. for profit or loss. In this regard, there is a need to control the production process, i.e. costs, output volume, its competitiveness and quality, etc.

A significant role in this is given to accounting, which reflects continuously and interconnectedly all business transactions, while ensuring the reliability, timeliness and overall accuracy of information based on documents. 14

Organizations are given the right to independently determine the composition and volume of production costs that form the cost of production and directly affect the financial result of its activities.

Costs - expressed in monetary terms, the amount of resources used for certain purposes. 36

An audit is an independent check by auditors and audit organizations of financial statements and other documents of legal entities and individuals in order to assess the reliability and compliance of financial and business operations with the legislation of the Republic of Kazakhstan. 26

The purpose of an audit is to express an opinion on the financial statements that gives an idea of whether the financial statements, in all material respects, are prepared in accordance with the financial reporting framework. This main goal can be supplemented by conditional contracts with customers, identifying reserves best use financial resources, correctness analysis, tax assessment, development of measures to improve the financial position of the enterprise, optimization of costs and performance, income and expenses.

Timely provision of consulting assistance allows the client enterprise to avoid shortcomings in accounting and errors in reporting.

The production process is the main one in the economic activity of the enterprise, which means that the accounting and audit of production costs is a responsible area for the work of accounting and auditing. Therefore, when examining this cycle, the auditor should understand the control procedures applied to production and shipment. finished products, storage stocks of raw materials. Based on such information, the auditor determines whether the company's policies and procedures for control are properly developed and applied for specific business transactions. Most of the sources of audit evidence are internal documents created by the economic entity itself, which reduces their audit value. Therefore, for successful verification, it is especially important for the auditor to have a sufficient understanding of the features of the client's business, the essence of its production process, as well as visual familiarization with the production process. 17

1 . Theoretical aspects of accounting for the production cycle

1.1 Organization of production and production accounting at the enterprise: general provisions and classification of production costs

Production is a fundamental process in the economic activity of an organization. This process affects the financial result of the organization, i.e. for profit or loss. In this regard, there is a need to control the production process, i.e. costs, output volume, its competitiveness and quality, etc. 14

A significant role in this is given to accounting, which reflects continuously and interconnectedly all business transactions, while ensuring the reliability, timeliness and overall accuracy of information based on documents.

The main tasks of accounting for production costs:

Timely, complete and reliable reflection of the actual costs of production and marketing of products;

Calculation (calculation) of the actual cost certain types and all commercial products;

Providing management structures with the information necessary for management production processes and decision making;

Control over the economical and rational use of material, labor and financial resources.

The cost of goods sold, works, services is formed on the basis of expenses for ordinary activities recognized both in the reporting period and in previous reporting periods, and carrying costs related to the receipt of income in subsequent reporting periods.

The principles for accounting for inventories in the IFRS accounting system are governed by IAS 2 Inventories and section 12 of the NFRS.

In addition to expenses from ordinary activities, operating, non-operating and extraordinary expenses are involved in the formation of the financial result, but they are not included in the cost of production. 29

Expenses for ordinary activities include:

Expenses associated with the acquisition of raw materials, materials, goods and other stocks;

Expenses arising directly in the process of processing (refining) stocks for the production of products, performance of work and provision of services and their sale, as well as the sale (resale) of goods (expenses for the maintenance and operation of fixed assets and other non-current assets, as well as for maintaining them in working or good condition);

Business expenses;

Management expenses, etc.

These expenses are reflected in accounting in monetary terms.

In accordance with NFRS 2 and IFRS 2, expenses are subject to recognition in accounting, regardless of the intention to receive revenue, operating or other income and the form of calculation (cash, exchange, offset). Expenses are recognized in the reporting period in which they occurred, regardless of the time of actual payment. Money or other form of payment.

In accounting, an organization can recognize a particular expense if the following conditions are simultaneously met:

The expense is made in accordance with a specific contract, the requirement of legislative and regulatory acts, business customs;

The amount of the expense can be determined;

There is confidence that as a result of a particular transaction there will be a decrease in the economic benefits of the organization. Such assurance exists if the entity has transferred the asset or there is no uncertainty about the transfer of the asset. If at least one of the above conditions is not fulfilled, accounts receivable are reflected in the accounting records.9

It should be noted that, in accordance with the standards, depreciation of property, plant and equipment and intangible assets is recognized as an expense in the amount of depreciation charges determined on the basis of the cost of depreciable assets, the period beneficial use and accepted in the organization methods of depreciation.

When forming expenses for ordinary activities, they should be grouped according to the following elements:

materials;

Salary;

Deductions for insurance;

Depreciation of funds;

Other costs.

Organizations are given the right to independently determine the composition and volume of production costs that form the cost of production and directly affect the financial result of its activities. 43

The cost of products, works, services of the organization includes the costs associated with the use of natural resources, raw materials, fuel, energy, fixed assets, labor and financial resources and other costs for its production and sale in the production process, including:

Costs directly related to the production of products, due to the technology and organization of production, including the costs of monitoring production processes and the quality of products;

Costs for the preparation and development of the production of new types of products;

Expenses associated with invention and rationalization, production and testing of models and samples, organization of exhibitions;

Costs associated with the maintenance of the production process;

Maintenance costs normal conditions labor and safety;

Costs associated with production management;

Payments provided for by labor legislation for unworked time, payment for regular and additional holidays, etc.;

The amount of accrued social tax;

Costs for the reproduction of fixed production assets, included in the cost of production in the form of depreciation;

Amortization of intangible assets;

Other expenses.

The cost of production also includes losses from marriage, losses from downtime for internal production reasons. 39

The formation of accounting information on costs, their classification, the composition and types of industries, manufactured products, work performed and services provided should be preceded by the process of developing an appropriate plan by the organization. It should contain indicators, including the composition of the cost of production, the calculation of sales prices, profits, etc., which are deciphered in the context necessary for accounting synthetic and analytical accounting (managerial) and financial - for reporting. Based on this information, the accounting department forms and develops the accounting policy of the organization.

Any commercial enterprise strives to make such decisions that would provide it with the maximum possible profit. Product costs are one of the important components on which profit depends.

Costs - expressed in monetary terms, the amount of resources used for certain purposes.

A cost objective is any activity for which costs are measured separately. Examples include a product, shop, sales area, or other identifiable activity.

1. Product costs and period costs. Product costs are associated with the production of finished goods. These costs are included in the cost of inventory (resource-intensive costs). Product costs include basic materials, basic labor, and manufacturing overheads.

Period costs are expensed in the period in which they are incurred and are not included in the cost of inventories. Period costs include sales and administration costs. 23

2. Direct and indirect costs. According to the method of inclusion in the production cost of production, costs are divided into direct and indirect. Direct costs are caused by a particular type of product. They can be easily attributed to a certain type of product at the time of their commission based on the data of primary documents. These include the costs of raw materials, materials, the wages of production workers, that is, primary costs.

Indirect costs are formed for several types of products. As a rule, they include production overheads. Which cannot be directly attributed to a specific type of product, therefore, the total amount of costs is allocated to products on the basis of special rates.

Manufacturing costs (primary labor, primary materials, and manufacturing overheads) are accumulated and shown in the Statement of Goods Produced and Statement of Cost of Goods Sold. These reports can be prepared separately or combined into a report on the cost of goods manufactured and sold.

The cost of goods manufactured takes into account the production costs attributed to finished goods produced during the period. To calculate the cost of goods manufactured, production costs incurred during the period are increased or decreased by the net change in work in progress (work in progress boss minus ending work in progress). 31

The cost of goods sold shows those expenses that are compared with income. To calculate cost of goods sold, cost of goods manufactured is increased or decreased by the net change in finished goods inventory (initial finished goods inventory minus ending finished goods inventory).

Cost behavior refers to the change in costs as the level of activity changes. variable costs depend on the volume of production. A change in volume causes a directly proportional change in costs. Variable unit costs remain unchanged. Examples of variable costs are raw materials, labor of the main workers, commission costs. fixed costs remain the same regardless of the volume in a given area of relevance and at a given time. Fixed costs per unit of output decrease as output increases and increase when output decreases. Examples of fixed costs include depreciation, rental and insurance of assets, and administrative expenses. semi-fixed costs depend on the volume of production, but do not change in direct proportion to it: they grow in steps, that is, they are constant up to a certain level of volume, after which they become variable; for simplicity, they are considered either constant or variable. 22

Mixed costs consist of a constant and a variable part. Mixed costs are also called semi-variables . For the analysis of mixed costs, the method of the largest and smallest values is used. The essence of this method is to study the cost and volume of production over the past period, choose the highest and lowest levels of production and compare the changes in costs that have occurred as a result of production at these two levels.

Relevant and irrelevant costs and revenues change when a decision is made, while making any decision does not affect irrelevant costs and revenues. Instead of the terms "relevant" and "irrelevant" costs, the terms "avoidable" and "non-removable" costs can be used.

Avoidable costs - these are the costs that can be avoided, which can be saved if you do not take some Alternative option, while non-recoverable costs will be incurred anyway.

Sunk costs are costs that have been incurred and cannot be changed by any subsequent decision. These costs should be ignored when analyzing subsequent courses of action.

Opportunity Costs are defined as the potential benefit that is lost or sacrificed as a result of choosing one of the options for action, in which the rest of the options have to be abandoned.

Incremental costs (differentiated) are any costs that occur in one course of action but are absent in whole or in part in another course of action. Incremental costs can be both fixed and variable costs. 22

Standard costs is the planned cost per unit of product. They are used to draw up estimates and evaluate the implementation of planned results. At the end of the estimated period, the actual costs are compared with the standard costs to identify deviations.

Controlled and uncontrolled costs. Controlled costs are subject to regulation by the manager, whose area of responsibility is related to these costs. The goal of the manager is to minimize costs and estimate based on planned and actual costs.

NFRS 2 gives a specific list of costs that form the cost of inventories, including acquisition costs, transportation and procurement costs, processing of products, and so on.

Inventory acquisition costs include the purchase price, import duties, taxes (other than those subsequently recovered by the taxing authorities), transportation, handling and other costs directly attributable to the acquisition of finished goods, including fixed and variable overheads:

- fixed overhead remain relatively unchanged and do not depend on the volume of production: for example, depreciation, maintenance costs of industrial buildings and equipment, production and administrative and management costs;

- variable manufacturing overheads are directly related to changes in volume and are charged to each unit of output on the basis of actual capacity utilization. If the processing costs of each product cannot be determined, these costs are allocated on a rational and consistent basis, and where by-products are immaterial, their value is estimated at their realizable value less costs of completion and sale. The resulting amount is deducted from the cost of the main product.

As a result, the book value of the main product differs slightly from its cost.

Under NFRS 2, an entity must allocate fixed production overheads to processing costs based on normal capacity utilization (normal capacity is the average production over several periods under normal conditions, taking into account capacity loss due to scheduled maintenance).

The amount of fixed overhead charged per unit of output does not increase due to low production or idle equipment. Unallocated overhead costs are recognized as an expense in the period in which they are incurred. During periods of unusually high levels of production, the amount of fixed overhead charged to each unit of output is reduced so that inventories are not measured in excess of cost. Variable manufacturing overheads are charged to each unit of output based on actual capacity utilization. 25

If more than one product is produced in a production process, and the costs of producing each product cannot be determined separately, then it is necessary to allocate such costs among the products on a rational basis, for example, on the relative cost of sales. If the by-products are immaterial, they can be measured at their possible selling price, including the costs of completion and sale, and then subtract the resulting amount from the cost of the main product. As a result, the book value of the main product differs slightly from its cost. Possible net realizable value represents the estimated selling price less estimated costs of completion and sale. Inventories are written down to net realizable value subject to the following principles:

Each service is treated as a separate item;

Similar articles are grouped together;

Writing off is done item by item.

The carrying amount of inventories is recognized as an expense when they are sold in the period in which the income is earned. 27

Inventories allocated to other assets as components of separate items are recognized as an expense over the useful life of that asset. The amount of any write-down of inventories to net realizable value is recognized as an expense or loss in the period of the write-down. Possible net realizable value represents the estimated selling price less estimated costs of completion and sale. Estimates are based on reliable data at the time of calculation, subject to the following principles:

The following are excluded from the cost of inventories (clause 224, section 12 of NSFR 2):

Implementation costs;

Administrative overhead;

Storage costs if stocks are not provided for further production process;

Excess damage to materials, labor costs, overhead costs.

If service providers have inventory, they measure it at cost of production. This cost includes the cost of personnel directly involved in the provision of services (including supervisory), as well as related overhead costs. Salaries and expenses for sales and general administrative personnel are not included in the cost of inventories, but are recognized as expenses in the periods at the time of their occurrence. The cost of a service provider's inventory does not include profit margins or indirect overheads, which are often found included in the price of services. eighteen

Inventories of agricultural products derived from biological assets are measured at initial recognition at their fair value less costs to sell at the time of harvest.

When accounting for a company's reserves and reporting them in the financial statements, it must be taken into account that there are certain risks associated with these assets.

Goods may become obsolete, damaged, they may expire before the moment the goods are sold. In connection with such events, the economic benefits of the company may decrease.

Inventories must be assessed at each balance sheet date to determine impairment by comparing the carrying amount (for each inventory item or group of similar items) to its selling price less costs to complete and sell.

The sale price, less costs of completion and sale, is reassessed in each subsequent period.

If the circumstances that previously caused the inventory to be impaired no longer exist, or it becomes apparent that an increase in the selling price less costs of the impairment due to a change in economic conditions becomes apparent, the entity shall reverse the amount of the impairment so that the new carrying amount is the lower of cost or the revised selling price minus the costs of completion and sale.

To choose an economically viable method of accounting for reserves and accounting policies, the organization must decide on the result of its activities (high or low profit) that is necessary for itself. The simplest and most accessible method of accounting is accounting for the weighted average valuation of reserves. The inventory structure (raw materials, work in progress and finished goods) is an important factor in production planning. For example, a decrease in stocks of raw materials and materials with an increase in work in progress may indicate a decline in production. At the same time, an increase in inventories may indicate an expected increase in production and sales, an increase in the volume of orders received.

The level of inventory and the receivables with which they are associated (for a certain period), in relation to the volume of sales, makes it possible to establish the impact on them of demand, profit, etc. An increase in receivables and inventories can be a harbinger of problems. For example, a doubling of stocks of finished products simultaneously with an increase in receivables, combined with a slow growth in sales, will indicate the need to change the company's policy in this direction. 28

Low turnover of goods can serve as an indicator of an erroneously chosen production policy.

The following information is disclosed in the financial statements:

Accounting policy adopted for estimating reserves, including calculation formulas;

The amount of inventories carried at fair value less costs to sell;

The amount of any write-off and recovery of the write-off;

Circumstances or events that led to the recovery of the write-off;

Reserves pledged against obligations;

The amount of inventory recognized as an expense.

Direct wages refers to those costs of production labor that can be easily associated with the manufacture of products. Direct production labor can include the labor of workers on the production line, assembly line, associated with the execution of a specific order. Labor costs that cannot be directly correlated with the manufacture of products are called auxiliary, or indirect, labor. They are charged to production overheads and then distributed at the appropriate rate to the products. In other cases, indirect wages are treated as an expense for the reporting period and charged to the profit and loss account as incurred. Indirect labor includes the wages of shop foremen, foremen, engineers, security guards and shop cleaners. thirty

Labor costs are accounted for in the following areas:

Accounting for labor costs, which must be attributed to the cost of individual operations and overheads;

Payroll accounting, which is associated with the registration of amounts due to workers, tax authorities, payable to the pension fund and other funds for the work performed.

There are a large number of primary accounting documents that are diverse in content, form and validity for accounting for production labor costs. An example is a record card, which takes into account the costs of a specific job (order), and an attendance sheet, which reflects the time worked by workers.

1.2 Documentation, accounting and distributionmaterial, labor and financial resources spent in production

The main task of accounting in this area is given to the calculation of actually used resources, the inclusion of their cost in the cost of products, works, services. In certain cases, there are difficulties in calculating the amount of write-off costs in the production of any type of product or order. In this regard, the accounting department is recommended to maintain special accounting registers in which it is necessary to collect information on expenditure items for their subsequent distribution between types of products, works, services.

Accounting and distribution of material consumption

Materials are released into production on the basis of properly executed documents by weight, volume, area or account, in strict accordance with the norms and requirements of the technological process. Orders of the Ministry of Finance of the Republic of Kazakhstan dated March 11, 2004 No. 117 and dated March 19, 2004 No. 128 approved the forms for accounting materials that any organization must use when processing the relevant expenses. The process of distribution of used materials is carried out on the basis of primary documents, which are grouped:

By types of material and production costs;

By places of use (workshop, department, site, etc.);

By orders (types of products, works, services);

By item of expenditure. 43

When developing an accounting policy for an organization, financial managers can choose one of the options for calculating the actual cost of materials used:

1. Based on the average cost of each type of material.

Example. Material N unit - kg

a) balance at the beginning of the month 30 kg at 1000 tenge 3000 tenge

b) income for the reporting period 500 kg at 1200 tenge 600000 tenge

Total income with the balance - 530 kg 630000 tenge

c) the average cost of 1 kg - 1188.7 tenge (630000 / 530);

d) spent for the reporting month (400 kg 1100 tenge) - 440000 tenge;

e) balance at the end of the month (130 kg 1100 tenge) - 143000 tenge

2. The FIFO method is used when stock prices decrease, when the highest price will be the first batch in time. Table 1 clearly shows the distribution of material consumption for March 2008.

Table 1. Distribution of material consumption for March 2008

|

Name |

Credit accounts |

||||||

|

Motor A Motor B Motor B |

|||||||

|

Total account 8100 |

|||||||

|

Tests, experiments |

|||||||

|

Total account 8400 |

|||||||

|

Total shop 01 |

|||||||

|

Motor A |

|||||||

|

Motor B Motor B |

|||||||

|

Total account 8100 |

|||||||

|

Current repair of facilities, equipment |

|||||||

|

Tests, experiments |

|||||||

|

Total account 8400 |

Example. Material N.

A) the balance at the beginning of the period 70 kg at 3,000 tenge - 210,000 tenge

B) received for the reporting month

1st batch of 140 kg for 2500 tenge - 350000 tenge

2nd party 220 kg for 1500 tenge - 330000 tenge

3rd party 150 kg for 1000 tenge - 150000 tenge

Total 580 kg 1040000 tenge

C) balance at the end of the month 130 kg * 1000 tenge = 130000 tenge

D) released for the reporting month 470 kg

Including batches of 70 kg for 3,000 tenge - 210,000 tenge

140 kg for 2500 tenge - 350000 tenge

220 kg for 1500 tenge - 330000 tenge

40 kg for 1000 tenge - 40000 tenge

Total 470 kg - 930000 tenge

The balance at the end of the month will be 210,000 + 104,000 - 930,000 = 320,000 tenge.

Thus, the above variants of methods for calculating the cost of consumable materials are applicable when:

Reduced nomenclature of inventory;

Separate accounting of incoming parties;

Mandatory their analytical accounting in quantitative and price terms. 24

Table 2 clearly shows an example of the distribution of transport and procurement costs.

Table 2. An example of the distribution of transport and procurement costs (TZR)

During the processing of materials during the production process, waste is generated. These include the remains of materials that have been formed as a result of technological processing and have lost in whole or in part the qualities inherent in this species materials.

Waste that can be used to manufacture products, perform work, services or for household needs is called returnable.

Waste that does not represent any consumer value (not used within the organization, not subject to sale to the outside, as well as invisible waste, shrinkage, waste, etc.) is called irrevocable.

The cost of returnable waste reduces the amount of production costs, which requires an accounting entry in the accounts:

Dr. c. 1310 "Raw materials"

Set of c. 8100 "Main production"

On the basis of documents on delivery to the waste warehouse, grouping lists are compiled for writing off the cost of waste from the relevant orders, works, services. audit cycle production cost

These amounts are reflected in the cards for the analytical accounting of production costs for orders under the item “Returnable production waste” with a minus sign and in statement 2 to the journal-order No. 10 with an accounting entry (debit account 1310, credit account 8100). 7

Deferred expenses are formed in connection with the development of new types of products, preliminary subscription to special literature, property insurance, performance repair work etc.

Upon the fact of making expenses, account 1620 “Deferred expenses” is debited for their amount. As the relevant reporting periods come, the related expenses are subject to distribution. Depending on the content of expenses, two methods of their write-off are used. The first method is used when mastering the production of a new type of product, which entails certain costs, planned and accounted for according to the established nomenclature of items. As the specified products are transferred to mass production, the development costs are subject to monthly inclusion in the cost of this type of product in installments. The amount to be written off depends on the number of manufactured products of this type and the established rate of consumption of raw materials and materials for their production. 39

Example. Expenses for mastering the production of new products amounted to 1,600,000 tenge. Production plan for the coming year - 4000 units. Write-off rate per unit of production - 400 tenge (1600000/4000). Production output per month - 30 units, 12,000 tenge (400 * 30) are written off:

Dr. 8100 "Main production"

12000 tenge

Kt 1620 "Deferred expenses"

12000 tenge

The second method is used for the cost of repairing fixed assets and other expenses of a similar content. Such expenses are written off in equal shares in the reporting period to which they relate.

Example. In February 2008, equipment was repaired for 1,200,000 tenge (Dt 1620 “Deferred expenses”, Kt 3310). In accordance with the decision of the administration, the cost of repairs will be written off to the cost of production within 6 months. In February, one sixth of the semi-annual amount, or 200,000 tenge, was written off (Dt 8400, Kt 1620).

Accounting for production losses

During the production process, unproductive costs may arise that increase the cost of products, works and services. These costs are primarily losses from defective products. According to the place of detection, internal and external marriages are distinguished. Internal marriage is detected in the organization before the products are sent to customers, external marriage is established by the buyer. Depending on the type of marriage, it is divided into correctable and final (irreparable) marriage.

Correctable marriage requires additional costs to bring products to the required quality. The organization can partially reimburse the costs of the marriage by deducting from the perpetrators of the marriage and the cost of capitalized inventories (waste).

The difference between scrap costs and reimbursed workers or suppliers is the scrap loss. Marriage is formalized by notices or acts, production documents, in which the number of suitable and rejected parts or products is recorded. 14

Losses from internal irreparable marriage. This type of marriage is characterized by the fact that rejected products or parts are withdrawn from production. In this regard, it is necessary to allocate from the total production costs that part that falls on rejected and withdrawn products or parts, and write off its amount from account 8010 "Main production" under cost items to account 8048. To do this, calculate the cost of rejected products by cost items in the following way:

The cost of raw materials and materials is calculated according to the norms with a price at contractual prices, the amount of transport and procurement costs is added and the cost of returnable waste is excluded;

The salary is determined according to the norms, the social tax, including the last operation before which the marriage was discovered;

Overhead costs are calculated according to the norms provided for in the normative or planned cost estimate.

General business expenses, the cost of special-purpose tools and fixtures, and other special expenses are not included in the calculation of the cost of rejected products. 25

Losses from an irreparable marriage. The marriage discovered by the buyer is usually reflected in the documents not for the month in which the rejected products were manufactured, but later, since the cost of the product has already been written off from account 8010 "Main production". Therefore, an external irreparable marriage is valued at the cost of production. In addition, losses from rejects include shipping costs that were billed to the buyer and shipping costs for returning defective products.

Non-production expenses included in the cost of products, works and services also include losses from downtime. Downtime can be associated with non-supply of energy, lack of materials, but during this period, workers are paid wages and deductions from it, which will amount to the amount of losses from downtime. A downtime is documented in acts indicating the downtime and the reasons for the circumstances that led to the downtime.

2 . Consolidated accounting and audit of production cycle costs of Pioneer-Lux LLP

2.1 Synthetic and analytical cost accounting for production

The production process and the variety of production costs require the use of a group of production accounts of subsections of the Standard Chart of Accounts: 8100 "Main production", 8200 "Semi-finished products of own production", 8300 "Auxiliary production", 8400 "Overhead costs". 39

To ensure the accounting of production costs by elements and costing items, all the costs of the main production are grouped by types of manufactured products on the accounts of subsection 8100 “Main production”. The account is calculated according to the purpose, according to the economic content it characterizes the state of economic processes.

Section 8300 “Auxiliary production” determines the cost of products and services of auxiliary production that are consumed by the organization’s divisions (for example, steam generated by a steam boiler shop is consumed for heating shops and plant management). In this regard, the cost of products and services of auxiliary industries is included in the cost of maintenance and production management. The system of production accounts allows you to group costs and keep track of them in the following sequence:

a) cost elements for the month are reflected in the debit of production accounts (materials, wages, depreciation, etc.);

b) deferred expenses are written off and future expenses of this month are reserved;

c) expenses are written off or distributed among the works of auxiliary productions;

d) the costs of the main workshops are summarized and distributed;

e) losses from marriage are determined and included in the cost of production;

f) the cost of unfinished main production and output is determined.

To ensure the operation of the main production, the Pioneer-Luxs LLP includes auxiliary units such as mills, a paint booth, a carpentry shop. 35

mills. Mill equipment made in Russia, with a capacity of 24 tons of grain per day. Flour yield 71%. Operating time 300 days, 24 hours a day. The mills are located at Kievskaya 21/2. Grain is transported by road into the pit, from where it is fed with the help of a bucket elevator to the storage bunker located in the heated room of the mill. From the storage hopper, grain heated to a temperature of +15 C is fed to a grain cleaner from organic and inorganic impurities with metal trapping using magnetic devices. Then the grain is moistened and goes through the process of tempering for 10 hours. The grain prepared for grinding enters the grinding lines, consisting of 3 grinding systems, performed using roller machines of the Vs-600 type. Flour by grades and bran are obtained with the help of 3RSh6 type sifters and L502-0 type sieving machines. Flour and bran are packed into bags, weighed on a commodity scale, sewn up with a manual bag-sewing machine and transported to the flour warehouse on a hand truck. Waste of categories 1 and 2 is collected in bags, taken out of the mill and sold to the population. Category 3 waste is removed to places agreed with the sanitary and epidemiological supervision. The release of flour and bran by the consumer is carried out by motor transport.

During the operation of the equipment, grain dust is released, which is fed through the aspiration system into the 4BTsSh-550 cyclone. Cleaning air is thrown into a pipe 8m high and 0.5m in diameter. Air purification from flour dust is carried out using a bag filter.

Paint area. In the paint shop, wooden parts are painted and dried in a closed chamber. For painting, paint ML - 21111 - PM is used. During the year, 200 kg of paint and 200 kg of solvent are consumed.

joinery shop. During the operation of such machines as planer, planer, milling, circular and slotting, wood dust is released. The volume of timber is 20 m 3 /year. The operating time of the machines is 600 hours/year.

The activity of the organization includes three business processes: procurement, production and sale of products. Organizations may differ in technological process, structure, relationship and interdependence between structural units. The content, volume, type and form of presentation of information necessary to determine the costs of production, for management purposes, the organization forms independently. Of particular importance are the correct organization of accounting by type of product, work, service, division and its timeliness, i.e. proper organization of analytical accounting. 29

Analytical accounting indicators are used in the preparation of internal reporting, which is formed on information about the types, quantities, units of measurement, divisions, cost items of manufactured products.

Analytical accounting is maintained to detail the indicators of all accounts for accounting for production costs. The level of analytical accounting is determined by the indicators necessary for the organization to manage and control. For example, for account section 8100 “Main production”, in order to promptly provide managers with specific reliable information in analytical accounting, it is carried out for each order, type of work, type of product separately, in the context of costing items and places of work. Analytical accounting should provide a grouping of information on the balance of work in progress at the beginning and at the end of the month, on costs for the reporting month, on amounts written off as costs for marriage, on the cost of saved materials in production and on the cost of products manufactured, work performed, services rendered .

Analytical accounts are opened for the accounts of subsection 8200 “Auxiliary productions” (for example, a steam boiler house, a compressor plant, a repair shop, a transport shop, etc.), by types of production, and within them - by types of work, costing items, i.e. by analogy with the accounts of subsection 8100.

It should be borne in mind that the services provided by auxiliary production are used to a greater extent within the organization and only a part of them can be sold to third-party organizations.

Registration of business transactions, accumulation and grouping of information about these transactions are carried out in accounting registers. The purpose and procedure for maintaining registers are determined by the Law of the Republic of Kazakhstan “On Accounting and Financial Reporting”. The information contained in the primary documents accepted for accounting is accumulated and systematized in accounting registers, the forms of which or the requirements for which are approved by the authorized body and (or) the National Bank of the Republic of Kazakhstan in accordance with the legislation of the Republic of Kazakhstan. one

According to the Law of the Republic of Kazakhstan “On Accounting and Financial Reporting”, “the content of primary documents and accounting registers is information constituting a commercial secret, access to which is provided only to persons who have permission from the management or entrepreneur, as well as officials of state bodies in accordance with legislation of the Republic of Kazakhstan". 2

Persons having access to these documents are not entitled to disclose the information contained in them without the consent of their owner and do not have the right to use it for personal interests. Persons having access to information constituting a trade secret shall be liable for its disclosure in accordance with the legislative acts of the Republic of Kazakhstan.

The totality of various registers, the order of entries in them and the interdependence between them constitute the form of accounting. Currently, mainly journal-order and automated forms of accounting are used.

Let us give an example of the organization of analytical accounting of registers used in the journal-order form of accounting. Similar forms of registers can also be used when using other types of accounting, since such a structure of registers makes it possible to obtain managerial information, i.e. used in management accounting.

Primary documents reflecting the amount of production costs (requirements, limit-fence cards, work orders, payrolls, etc.) serve as the basis for compiling development tables for the distribution of material consumption and transportation and procurement costs (TZR), returnable waste, accrued wages, etc. The data calculated in the development tables are reflected in the production accounting cards. 28

With a shop management structure, costing items in the card are divided into shops, for example, shop No. 01, 02, 03, etc.

The analytical structure of production accounts includes items that allow grouping according to the criteria to be controlled:

Expenses for the maintenance and operation of equipment;

Expenses for the maintenance of shop managers;

Expenses for the maintenance of buildings, structures;

Labor protection and safety expenses;

unproductive losses;

Summation of production costs - synthetic information on the generalization of costs and other calculations that allow you to determine the total cost of the organization in the production process for the reporting period. This information makes it possible to judge the profitability of the production of products or the performance of works, services, the level of prices set in the organization, and the competitiveness of products. Most accurately, the composition and amount of expenses can be analyzed based on the data of the journal-order No. 10, which make up its various subsections. A characteristic feature of the order journal No. 10 is the possibility of dividing costs into two types:

1) by economic elements;

2) in the context of complex costs.

Section 3 of the journal-order No. 10 “Calculation of the costs of the reporting period by economic elements” allows you to adjust the results of the first section by amounts that increase and decrease the indicated totals. 43

2 .2 Audit of the production cycle: the relationship of accounts, verification procedures

Relationship of production cycle accounts

The production cycle is associated with material values that are produced for sale. Its verification is the most difficult and time-consuming. Most of the sources of audit evidence are internal documents created by the economic entity itself, which reduces their audit value. Therefore, for a successful audit, it is especially important for the auditor to have a sufficient understanding of the client's business features, the essence of its production process, as well as visual familiarization with the production process in workshops, warehouses and other production facilities. 17

Knowledge of the essence of the production process includes the following information.

Depending on the complexity of the technological process of manufacturing products, simple and complex production is distinguished. Such production is considered simple, which is characterized by a single continuous process of extraction and processing of products. Simple production usually has a short lead time and no work in progress.

Complex production includes production in which the process of manufacturing products consists of a number of separate independent redistributions, transitions, phases, stages. For example, textile, shoe, machine-building, meat, etc. Complex production always has a balance in work in progress. Industrial production, depending on the role of production of the main products, is divided into main and auxiliary.

The main ones include production facilities intended to manufacture products for the production of which the enterprise was created.

In various industries, the nomenclature of the main industries is different. For example, the main industries include: at a metalworking enterprise - linear, forging, mechanical, assembly shops; at a metallurgical enterprise - blast furnace, open-hearth, rolling, etc.

Ancillary productions are those that serve the main production and the entire enterprise as a whole. Service is expressed in the manufacture or repair of tools, repair of equipment, buildings, etc.

Auxiliary industries include: tool, mechanical repair, repair and construction shops, power plant, steam boiler, compressor station, vehicles, etc.

Part of the products of auxiliary industries can be sold to the side.

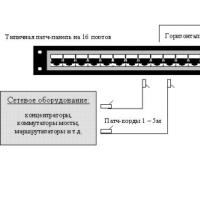

The system of accounting accounts related to the production cycle, and the relationship between them is shown in Figure 1 (Appendix 12). The arrows indicate the directions of the test. 7

The above relationship shows the composition of costs, allocation to cost accounts and their closure. So, in particular, the supply of raw materials, materials, labor costs, the accrual of reserves for vacation pay, deductions from wages for social tax, write-off of overhead costs are charged to the accounts of the main production and part of the costs - to the accounts of the expenses of the period. At the end of the reporting period, the accounts of the main production are charged to the cost of finished products, and the expenses of the period are closed by account 5610 "Total profit" (total loss).

Analytical procedure and substantive checks of the production cycle

The auditor must understand the control structure of the company to the extent that would allow him to plan the audit. This is necessary to identify possible misstatements or the risk of their occurrence and develop a methodology for substantive tests. The auditor analyzes what he already knows about the enterprise, reviews the results of the audit of the previous year, talks with the client's personnel, observes how the personnel perform their duties, reviews the descriptions of the control policies and procedures prepared by the client, examines documents and reports. 15

...Similar Documents

The essence of costs and their classification according to costing items. Documentation of accounting. Organization of synthetic and analytical cost accounting. Classification of expenses by economic elements. Improving production cost accounting.

term paper, added 01/22/2015

Theoretical aspects of accounting and analysis of production. Stages of the production cycle and their features in various sectors of the economy. Characteristics of the primary accounting of production; synthetic and analytical accounting of finished products.

thesis, added 04/16/2010

The concept of the conditional volume of production. Cost accounting and production accounting system. Analysis of the relationship between costs, volume of activity and profit. The sequence of accounting for process costing. Essence of budgeting and types of budgets.

term paper, added 01/17/2013

Economic content, objects of accounting for production costs and calculation of the cost of production in animal husbandry. Organization of primary, summary, synthetic and analytical accounting. Calculation of the live weight of animals for growing and fattening.

term paper, added 02/21/2011

The study of the classification of costs, costs and production costs. The concept, composition and methods of evaluation of work in progress, its reflection in financial and management accounting. Accounting for indirect costs and features of accounting for the costs of auxiliary production.

term paper, added 09/16/2014

The essence and objectives of accounting for production costs. The concept of summary accounting for production costs. Management of the cost of production of organizations. Methods of calculation established for the valuation of work in progress. Non-semi-finished cost accounting method.

term paper, added 04/24/2013

Analysis of production cost accounting methods. Characteristics of analytical and synthetic accounts. Financial and economic operations to reflect the accounting of production costs. Digital example of cost accounting for production, samples of applied documents.

term paper, added 10/23/2012

Goals and objectives of management accounting. Principles of organizing cost accounting for production at agro-industrial complex enterprises. Organization of accounting at the enterprise. The meaning and procedure for closing operating accounts. Closing of ancillary production accounts.

term paper, added 12/19/2011

Normative documentation of the audit of cost accounting for production. Audit of the classification and correctness of cost accounting. Used methods of cost accounting in terms of the method of preliminary control. Calculation of the actual production cost of products.

term paper, added 11/05/2014

Classification and tasks of accounting for production costs, regulatory documents governing their composition. accounting system, general characteristics registers of analytical and synthetic accounting of production costs at the enterprise under study.

The cycle of business activity "Production" is a set of technological operations, alternating in a certain sequence and repeating at a given pace, characterized by the production consumption of labor instruments (fixed assets and intangible assets), objects of labor (materials) and directly labor (payment for labor) in order to manufacture of finished products. This cycle of business operations also includes the processes of the emergence of work in progress, its transformation into a finished product, acceptance of finished products, all testing and delivery to a warehouse or expedition.

The practice of conducting an internal audit of the production cycle is the most time-consuming and complex area that requires a large amount of information, the speed of obtaining information and a good knowledge of production technology. As sources of information, the auditor can use the data (Fig. 8.4) of management and financial accounting, operational and statistical types of accounting. However, the information should be systematized in the aggregate, subject to the purpose of the audit.

Sources of information for the production cycle can be divided into six groups: primary documents; consolidated accounting documents; registers of analytical accounting; registers of synthetic accounting; internal and external reporting; extraneous documentation.

A feature of the workflow of the production cycle is that almost all primary documents are developed in the organization. It's loaded with primary documents different types accounting, it involves numerous forms of primary documents, similar in content and differing in construction. Each document goes through many stages, and each functional unit organizes its own information system about production with many indicators of internal reporting.

As sources of information that require knowledge of accounting, there are registers of analytical and synthetic accounting for accounts (the system of accounts will depend on the form of construction of cost accounting for production used - one circular or two-circular integrated form, an autonomous form of organizing financial and management accounting) 02 "Amortization fixed assets". 05 "Depreciation of intangible assets", 10 "Materials", 70 "Settlements with personnel and wages", 68 "Calculations for taxes and fees", 69 "Calculations for social insurance and security", 20 "Main production". 23 "Auxiliary production". 25 "General production expenses", 26 "General expenses", 40 "Output of products (works, services)", 43 "Finished products", 90 "Sales".

Rice. 8.4. Sources of information for the audit of the "Production" cycle

This indicates the need to carry out an internal audit directly in the hall of technological operations, i.e. current control. For each economic entity, due to its technological, organizational and production features, it must have its own specific verification methods. It is the organization of such an audit, which is carried out, as a rule, for individual production processes, that systematically allows the controlling person to detect miscalculations in a timely manner and promptly take measures to eliminate them. The main purpose of operational audit as a type of internal control is to anticipate the possibility of deviations in the future, while being guided by historical data in the study.

The purpose of the internal audit of production, performance of work and provision of services is to check the status and identify the availability of reserves to improve the efficiency of resource use in four complexes (inventory and costs, output and cost of finished products) of production management objects (Fig. 8.5).

Rice. 8.5.

Each of the objects listed here consists of several items of verification that must be audited in the sequence of stages of the production process; preparation and development of production; direct production of products from the moment they are launched to the acceptance and release of finished products, completed orders, etc.; product quality assurance; maintaining the means of labor in working condition; production management (management); waste disposal and environmental activities.

Here, the production process is understood as a set of sequential actions (functions) aimed at achieving certain results. According to this provision, the auditor must be well aware and know the essence of the stages of production, the features of the technological process, the production structure of the organization, since this will allow classifying production costs, grouping them according to certain signs suitable for internal audit.

Further, the audit of the organization of production is carried out according to the stages of the production process. The first stage includes the preparation of production and the development of new products. At the stage of preparation and development, the auditor pays attention to: the development of new, modern concepts and strategies in this area; concentration of forces and resources on R&D as the main component of innovation and production preparation in close coordination with the production infrastructure, quality management systems and competitiveness of the enterprise.

For the purpose of auditing, the pre-production stage should be divided into seven types of processes (marketing pre-production, research and development, design and development, technological, organizational, economic, social and environmental preparation). Such a classification allows you to check the actual result obtained from the implementation of measures and compare it with the desired value (planned profit).

The stage of development of new products is considered from the position of four types of processes: tooling; repair and energy supply; transport and warehouse support; other areas of production infrastructure. The results of the check can be promptly used to eliminate the detected deviations, thereby accelerating the development of new products or the application of new technology.

The costs of preparing and mastering the production of new products and technologies are of a one-time nature, are formed before the start of the production cycle, and have a diverse composition. In this regard, the auditor must make sure that the recognition of costs as expenses for development and training is justified and that the choice of accounting policy for including these costs in the cost of production and sales is correct.

Directly the production process in any organization is the main one that determines the essence of its production activities. This main process includes a block of operations that are directly related to the product of the enterprise and thus affect the creation of added value. For successful internal audit of this cycle, the scientific classification of production processes is important. In this aspect, the most appropriate for auditing, for example, a machine-building enterprise, is the classification of production processes based on the allocation of an elementary part of the technological process in the form of an indivisible technological operation, its organizational form, and the criterion for selecting operations will be the volume of labor intensity of work.

The technological process in mechanical engineering, in its organization and construction, is a functionally completed production site, with the ultimate goal of producing products of a certain volume. In this branch of the economy, one should use such a characteristic of the technological process as a system with its inherent features; production of a certain volume of products of a specific name, expressed in hours of labor intensity; the structure of technological operations in the form of their set based on the fund of working time, the complexity of models and a series of orders; estimated output, volume of production, labor intensity of an indivisible operation.

The grouping of indivisible technological operations according to the above criteria will allow the organizers of the internal audit of production to obtain information about each workplace, the efficiency of the use of labor resources, determine the level of their qualifications, labor productivity, changes in the relationship between performers and technological operations, the optimal allocation of responsibility centers, as well as the correct choice criteria for their organization.

When updating the product range, the stability of the grouping will depend on the redistribution of the scope of work and technological operations between the performers, maintaining the speed of movement and the route of the material flow. In this case, it becomes necessary to investigate the existing communication between the production sites of workshops or responsibility centers for the timeliness of obtaining information and the controllability of task execution (Fig. 8.6). At the same time, the auditor should remember that the divisions of the enterprise that directly carry out the production process or contribute to its implementation, their composition, the distribution of functions between them form the whole production system and the communication network of the enterprise.

For example, a communication network is shown between six production sites of the Smolensk distance of the Moscow Railway, which are serviced by three teams specialized in types of work. The network is built on the principle of "each with each", since there is no site in it that occupies a dominant position.

Rice. 8.6.

Brigade No. 1 was allocated as the center of responsibility with the functions of directly executing the measurement schedule, inspecting the track, diagnosing the site by means of track measurement and flaw detection, identifying deviations in the parameters of the technical condition of track facilities, filling out reporting documentation for fixing the identified deviations, transferring documentation to the technical department for further planning of work, preparation of documentation to confirm the volume and quality of work performed by teams No. 2 and 3. Since the teams are specialized in execution functions and take part in servicing all sections of the track, even with the redistribution of technological operations within the teams, we can conclude that the communication network is stable and rationality of its construction.

A significant place in terms of labor intensity and the need for internal audit is occupied by the processes of studying the occurrence of costs, recognizing them as expenses. The variety of costs and the different directions of their spending predetermine the methodology, methods of conducting an audit and the sequence of its implementation. In accordance with the task, it is possible to determine the basis for classifying production costs to be verified (Table 8.3).

Table 8.3.

When collecting evidence, the auditor takes into account the provision according to which production costs are current and are included in the cost of the reporting period in which the production cycle takes place: "At the same time, such a classification is subjective, it does not reflect previously incurred costs that are not related with this solution in the situation of the reporting period.

The sequence of work carried out during the audit can be divided into three stages; introductory, main, final. At each stage, the auditors should consider and study a set of issues. Internal auditors pay special attention to detailed testing of the composition of costs and assessment of the organization of accounting for production costs and the state of the control system. In accordance with the test results, a plan and program of audit procedures are developed.

Rice. 8.7.

Checking the quality of manufactured products, work performed and services rendered requires the involvement of either specialists from departments that perform quality control functions, or outside experts. The implementation of planned measures to maintain and improve quality is subject to control. As in the previous two stages, it is recommended to apply the same organizational and technological approach during inspections, consistent with the industry specifics of production, the characteristics of activities and the product life cycle.

You can consider a multilayer hierarchical audit methodology, which consists of several stages (Fig. 8.7). The weight stages of the methodology include the selection of types and groups of products, their life cycle(active production, reduction, development of new ones), types of activity (supply, production, marketing). Stage I involves the allocation of blocks of procedures (Table 8.4).

Table 8.4.

The proposed grouping allows you to check the consistency of the data of the analytical accounting of finished products and the allocation of costs for providing established standards quality for the same analytical groups. A separate reflection of quality costs creates an opportunity for auditors to set the level of rigidity of rationing, budgeting, to ensure control over the execution of planned activities and estimates, and to determine the effectiveness of the activities carried out by means of comparative analysis the state of the product on the market.

Stage 2 is intended to establish the composition and conditions for recognizing the costs associated with product quality, as well as modeling their transformation due to a change in the life cycle of products and the development of new types and technologies for the production of products. At the same time, the costs can be grouped according to planned and actually carried out activities in the context of three groups: costs for maintaining quality; quality improvement costs; expenses for the development of new recipes, technologies, product names.

The remaining stages of the internal audit of quality costs are also focused on the implementation of the goal. Checking the tension of the norms and standards that form the basis of budgeting is necessary to establish the feasibility of directions for investing funds and resources, the reality of assisting in finding reserves of product quality, and monitoring the spending of funds. Most of the resulting quality costs are relatively easy to document with conventional primary accounting documents and can serve as a source of information for internal audit. Based on this, one should study existing system workflow and find out the degree of its isolation from the general system of registration of production costs. The next three stages are devoted to checking the reliability of the distribution of costs by quality between reporting periods and types of products, works and services. In table. 8.5 provides a list of procedures for internal audit of quality costs.

Table 8.5.

Therefore, applying an accounting approach to auditing activities related to quality and the costs incurred in connection with this, one can observe a logically consistent relationship between a set of audit evidence, the main source of which will be accounting (Fig. 8.8), in particular primary documents, registers of analytical and synthetic accounting, summary accounting of production costs.

The use of control procedures in the audit system of quality costs can significantly increase the efficiency of resource use, more accurately determine the profitability of each product, and develop an optimal assortment structure.

The internal audit of inventories will mostly concern the verification of work in progress, which can be located both in workshop pantries, procurement warehouses, and at workplaces. First of all, the accounting policy of the organization is subjected to verification in terms of recognizing products as finished and work in progress, methods for identifying the actual balances of work in progress and their evaluation, methods for accounting and valuing finished products.

Depending on the tasks set by the administration, the statement of operational accounting of the movement of the production process is checked - its connection with management accounting, internal

and external reporting. Here, auditors can carry out the following audit procedures presented earlier in Table. 8.5.

Rice. 8.8.

The study of the procedures for accounting and financial accounting of production costs should be carried out in the aspect of observing the sequence of registration of the facts of the course of production, similar to the technological process of manufacturing products, fulfilling orders and increasing costs. In the audit hall, the correspondence between the natural-material form of work in progress and the costs of its production is determined, which creates the possibility of checking the correctness of the adjustment of the financial result from the production of products and the execution of individual orders.

Typical errors identified during an internal audit of accounting for work in progress and finished products can be (Fig. 8.9):

1) separation of the natural-material form of work in progress from the processes of accounting for the occurrence and increase in costs;

Rice. 8.9.

- 2) a large share of conventions in identifying and evaluating work in progress in the inter-inventory period, when the source of calculations for the distribution of costs by periods, between the objects of accounting and calculation are inventories of workshops without indicating the degree of readiness of products and semi-finished products;

- 3) the real existence of inequality between the accounting and actual balances of work in progress;

- 4) the use of the "boiler" method of recognizing the costs incurred as expenses of the reporting period, which distorts the amount of costs at the places of their occurrence and violates the principle of responsibility for the costs incurred and material incentives for the use of resources;

- 5) accumulation in the closing balance from part 20 "Main production" of deviations of actual costs from the planned cost of manufactured products, which affects the amount of losses arising in production;

- 6) lack of connection between the conditions for the fulfillment of contracts and obligations to buyers and customers and the formation of the cost of producing products, providing services and performing work;

- 7) "contamination" of the remains of work in progress and finished products with materials that have not undergone processing, incomplete products that have not passed all stages of processing or have not been accepted by technical control, the customer, etc.;

- 8) the presence of inefficient management decisions made regarding the choice of assortment, the establishment of sales volumes due to inaccuracies and significant deviations in information on work in progress and finished products.

There may be other violations in the field of production costs and costing, such as: incorrect assessment of materials when writing off to production, illegal recognition of costs as expenses of the period, non-compliance with technological standards and organizational standards, economically unjustified write-off of deviations from the norms, etc.

The processes of production (types of production processes) and consumption of certain types of goods and services are accompanied by beneficial or harmful effects experienced by persons who are not directly involved in these processes. Such effects are called external costs (negative externalities)

What is the general scheme of powder paint production process?

The general technological scheme of the production process for the production of powder paint includes the following steps:

1 - preparation and dosing of feedstock;

2 - mixing of components;

3 - extruding the mixture (obtaining chips);

4 - grinding chips;

5 - packaging, packaging, labeling;

6 - quality control.

Quality control is singled out as a separate stage with a certain degree of conventionality. In fact, this stage is divided into separate components (sub-stages), which are an obligatory (final) part of each of the technology stages.

Preparation and dosing of feedstock. The stage begins with the receipt of raw materials to the warehouse of the plant and its acceptance. Raw materials can be supplied in bags or boxes, plastic containers volume, soft containers (big bags) weighing about 600 kg. When raw materials are accepted at the warehouse, the integrity and appearance of the packaging are checked, the quantity and name of the raw materials correspond to the data specified in the consignment note, the batch numbers are compared with the numbers in the quality passports. After acceptance, the amount of raw materials necessary for production is delivered to dosing sites using various devices, the rest of the raw materials are stored in a warehouse. A visual conformity assessment is also carried out at the dosing station appearance raw materials to certain requirements

Dosing of raw materials is carried out in the areas of small and large premixes according to the task for production. First, on a small premix, manual weighing is carried out on the scales of individual components of the PC, the content of which in the paint formulation is negligible. The operator punches and signs a check, which indicates the digital code of the weighted component and its actual amount. The mixture from the small premix is then transferred to the large premix.

Large premix allows you to dose the components of the PC formulation in large quantities. The raw materials received from the warehouse are poured into separate bunkers with the help of mechanical devices. The large premix operator selects a clean mobile (on wheels) container corresponding to the amount of loading, which is installed on floor scales under the bunkers. In a certain sequence with control by weight, the individual components are poured from the hoppers into a container (mixture from a small premix - manually). At the end of dosing, the operator punches and signs a check, which indicates the number of the component and its weighted amount. Then the container with the technological map and two checks from premixes is transported to the mixing area.

Mixing components. Depending on the size of the mobile container loaded with the mixture, the operation is performed by industrial mixers (mixers). The mixing mode is set on the control panel timer. To prevent overheating, chilled water is supplied to the mixing head of the mixer. Upon completion of the mixing of the components, the finished mixture (charge) in a container is transported to the extrusion site.

extruding the mixture. The production of paint melt in continuous mode is carried out on special equipment called an extruder. Different types of extruders differ from each other mainly in performance. Conventionally, the extruder can be divided into two levels: upper and lower.

The mobile container with the ready mixture is lifted to the platform of the unloading station (upper level) by means of mechanical devices and fixed on it with pneumatic grippers. The operator manually opens the valve of the container, and the mixture is fed directly into the extruder (lower level) using a screw feeder. Passing through the zone of forced heating at a controlled speed, the charge is melted and by means of the screws of the extruder itself, already in this state, it is mixed to a homogeneous state.

Hot melt (temperature 110-130ºС) is squeezed out from the discharge opening of the extruder and flows onto the cooling cylinders (rollers) of the continuous cooling system. Passing between two cylinders, the alloy is rolled out to the form of a tape with a thickness of 0.5 - 1.5 mm, cools down and passes into a solid state. Further, the cooled tape is fed through a belt conveyor to a crusher, where it is crushed to the state of flakes (chips) 10x10 mm in size. Acceptance of the final size and type of chips is taken in the grinding system.

Grinding chips takes place on the plant, which includes:

- turbofan;

- impulse mill-classifier;

- a cyclone with a system of unloading locks;

- fine cleaning system.

The turbofan creates a controlled air flow, through which the chips are transferred to the classifier mill, which works on the principle of impact centrifugal grinding. Further, the air flow directs the ground product into the cyclone and further, through the system of unloading filters, to the vibrating sieve (for different PCs, the cell size of the vibrating sieve may be different). On the sieve, a large fraction of particles is screened out and returned to the mill for re-grinding, and the commercial fraction of the product is fed to packaging.

From the cyclone, air containing powder dust enters the fine purification system. It consists of several bag filters located in one housing. Passing through bag filters, powder dust is deposited on their surface, and the purified air is released into the atmosphere. The dust from the filters accumulates in the dust collector and from there it enters the plastic bags. Bags are replaced as they fill up.

The concept of the production process and its types

The production process is a set of all actions and works to create consumer value that satisfies personal, collective (corporate) or public needs. The product is the result of the manufacturing process. Depending on the purpose, products are divided into consumer goods intended for consumption by the population, and goods for industrial purposes intended for consumption by enterprises and organizations in their work processes.

The main part of the production process is the technological process, which contains purposeful actions to change and determine the state of the objects of labor. During the implementation of the technological process, there is a change in the shape, size and physical and chemical properties of the objects of labor. As a result, individual parts, assemblies, assemblies are created.

The completed part of the technological process, performed at one or more identical workplaces without readjusting the means of labor with the participation or under the control of one or more workers (teams, teams), is called a technological operation.

Varieties of production processes

The production process is heterogeneous in its structure and content. It consists of a set of partial processes ordered in space and time in a certain way.

A partial process covers only part of the work required to obtain the final result of this process.

According to the content of the work performed, partial processes are divided into the following types:

basic;

auxiliary;

serving;

natural.